IRS Form 2290 Schedule 1

E-File 2290 and Get Stamped Schedule 1 in minutes.

Get Schedule 1 NowPricing Starts at $14.90

(Lowest Price in the Industry)

What is the Purpose of Using Form 2290 Schedule 1?

Form 2290 Schedule 1 is a proof of HVUT payment, and truckers use Schedule 1 form for the following purposes.

- Renew their tags

- Register their vehicles at DMVs

- Operate their vehicles on any public highways

- Give a copy to Carriers that they operate for

How to Get Form 2290 Stamped Schedule 1 with ExpressEfile?

Getting 2290 stamped Schedule 1 with ExpressEfile takes only a few minutes.

Follow the steps below and get your Schedule 1 form instantly.

The IRS encourages e-filing to receive your Schedule 1 immediately. E-file 2290 and get your Schedule 1 within a few minutes.

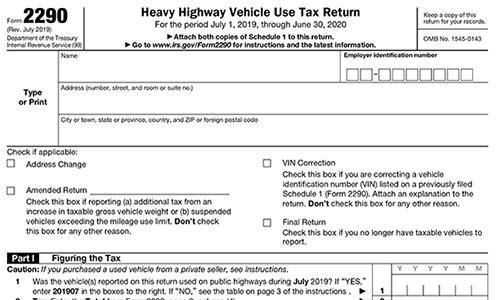

What Information is needed to Get IRS Form 2290 Schedule 1?

You’ll have to provide only a few basic information to get your stamped Schedule 1. Below are the information required:

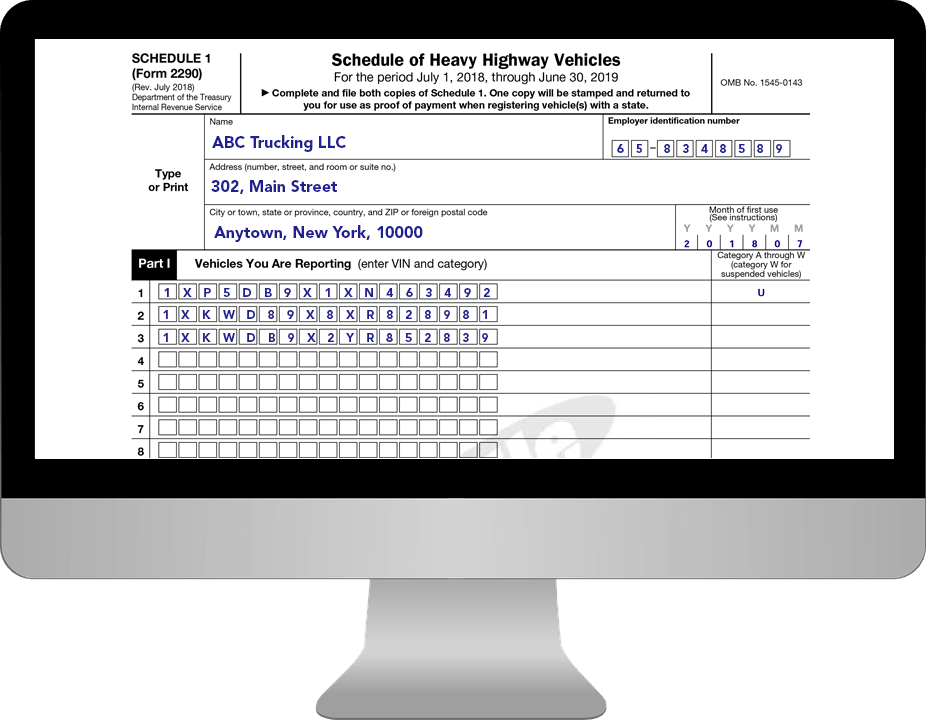

1. Business Details: Name, EIN, and Address.

2. Vehicle Details: First used month (FUM), Vehicle Identification Number (VIN), Taxable Gross weight category.

The IRS encourages e-filing to receive your Schedule 1 immediately. E-file 2290 and get your Schedule 1 within a few minutes.

E-File 2290 Now

File Your Form 2290 Online & Get Schedule 1 Immediately

The IRS encourages filers to e-file Form 2290 for quick processing and deliver your Schedule 1

within a few minutes.

Helpful Resources for Form 2290

Frequently Asked Questions

What is IRS Form 2290 Schedule 1?

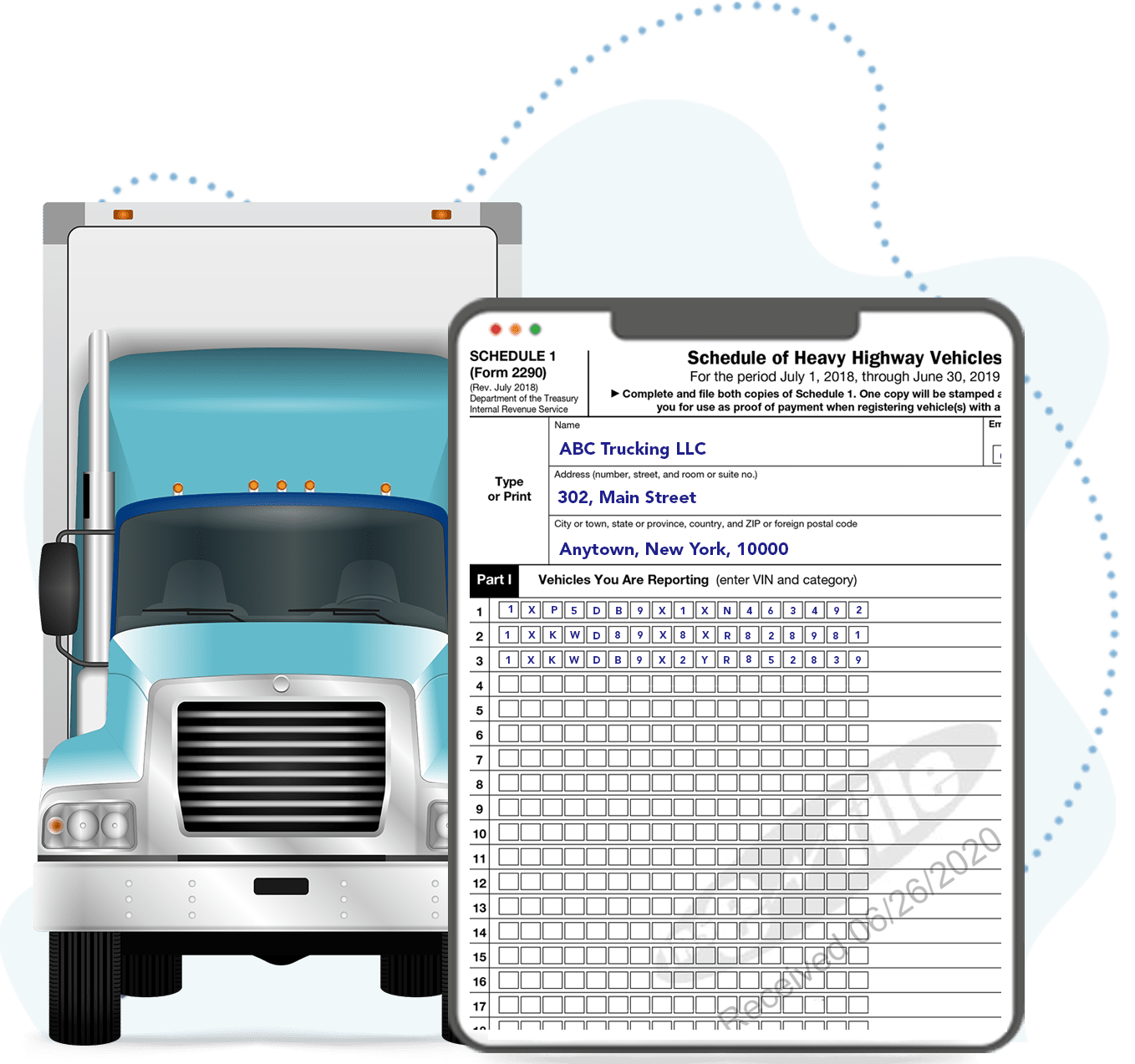

Form 2290 Schedule 1 is the proof of payment for Heavy Vehicle Use Tax (HVUT). Any truckers who have heavy vehicles with a taxable gross weight of 55,000 pounds or more must pay HVUT and file Form 2290 each tax year for using their trucks on public highways. The current period for HVUT begins July 1, 2022, and ends June 30, 2023. Usually Form 2290 has two copies of your Schedule 1 attached to it. One is for the IRS reference and another one the IRS will stamp it and send it back to use it as proof of a HVUT payment.

What is the Purpose of Using IRS Schedule 1?

Schedule 1 Form 2290 acts as proof of HVUT payment made for the taxable highway motor vehicle being used on public highways. It is necessary to have a Schedule 1 in order to register your vehicle in any state, DMV or DOT.

How to download Form 2290 Schedule 1?

File your Form 2290 using ExpressEfile and we’ll send you a digital copy of your stamped Schedule 1 with the IRS e-file watermark through email. You may also choose to download a copy of your Schedule 1 from the ExpressEfile dashboard.

How to file Form 2290 online?

File your Form 2290 online using simple steps. You just have to enter the business and vehicle information (EIN, VIN, and Taxable Gross Weight), and we’ll calculate the tax amount for each vehicle based on gross weight. Then, you can simply complete the form and e-file it directly with the IRS.

When is the deadline for Form 2290?

For vehicles used from the beginning of the July 1, 2022 - June 30, 2023 tax period, the deadline to file IRS Form 2290 is August 31, 2022.

If it's a new vehicle, Form 2290 must be filed with the IRS by the last day of the month following the month of its first use.