Form 941 Changes for

2nd Quarter, 2020

E-File 941 Now!

Complete Form 941 in less than 5 minutes.

E-File 941 for $5.95 per return.

Lowest Price in the Industry

Revised Form 941 for Quarter 2, 2020

Updated on June 11, 2021 - 10:30 AM by Admin, ExpressEfile

Form 941 has been revised to reflect new provisions that have been put in place during COVID-19. This form now contains fields to report the Families First Coronavirus Response Act, the CARES Act, the Economic Security Act, and other tax relief programs in place to offset the economic impact of COVID-19.

Taxpayers are required to use this version of Form 941 for their second-quarter filing, which is due

July 31, 2020.

In this article, we discussed the following points:

1. Form 941 - Quarter 2 Changes

The revised Form 941 has 23 new data entry fields. These additions allow eligible employers to receive and report COVID-19 related aid. Employers can defer payroll tax payments, and request refundable tax credits.

The IRS has revised Form 941 for Q2, 2021. The American Rescue Plan Act of 2021 (ARP), signed into law on March 11, 2021, includes relief for employers and their employees during COVID-19. As always employers need to report COVID-19 credits on Form 941, so the IRS has updated the form to reflect the ARP.

Here are some credits that employers can report on the updated Form 941.

1 (A). FFCRA Payroll Credit for Family and Sick Leave

The Families First Coronavirus Response Act allows employers to use refundable tax credits towards paying employee wages for qualifying family or sick leave. These provisions are in place from April 1, 2020, to December 31, 2020, and will need to be reported on Form 941.

The employer is not subject to the employer portion of social security tax imposed on the wages mentioned above.

1 (B). Employee Retention Credit

Under the CARES Act, Employee Retention Credit encourages employers to keep employees on payroll by granting them 50% of qualifying employee wages paid between March 12, 2020, and January 1, 2021, back in refundable tax credit. This tax credit can equal up to $5,000 per employee and can be used against certain employment taxes.

Employers can request tax credits and provide a record of their use on

Form 941.

The employer is not subject to the employer portion of social security tax imposed on the wages mentioned above.

1 (C). Employer Social Security Deferral

Employers can defer their share of social security tax payments till December 2020 in anticipation of their tax credits and record that decision when they file Form 941. 50% of the total deferred social security taxes can be paid before December 2021 and the remaining 50% can be paid before December 2022.

2. IRS Form 941 Updates

Whether or not employers take advantage of COVID-19 related relief, they need to file updated

Form 941.

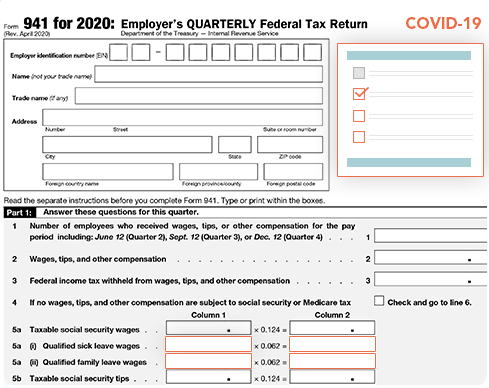

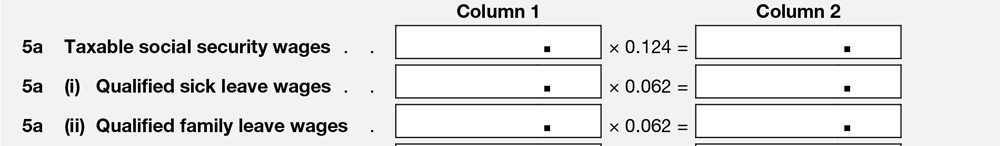

Here are the changes to Form 941 for quarter 2, 2020.

Part 1, Line 5a includes the employee share of social security tax on qualified sick and family

leave wages:

-

Line 5a (i): Qualified sick-leave wages.

Report the applicable amount of qualified sick leave wages that you paid your employees during the reported quarter because you were required to provide these payments under the Families First Coronavirus Response Act (FFCRA).

-

Line 5a (ii): Qualified family-leave wages.

Report the applicable amount of qualified family leave wages that you paid your employees during the reported quarter because you were required to provide these payments under the FFCRA.

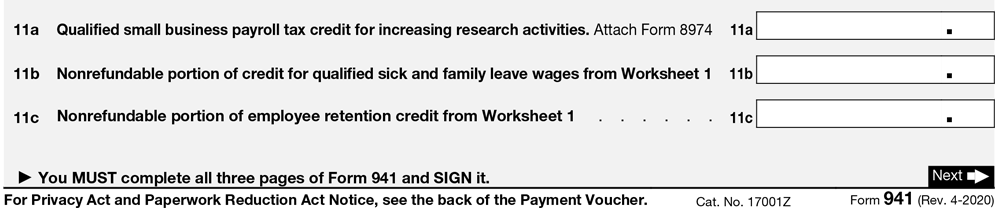

Part 1, Line 11 includes the new data fields below:

-

Line 11b: Non-refundable portion of the credit for qualified sick and

family wages.Use Worksheet 1 to calculate the amount of the combined credit for qualified sick leave wages and qualified family leave wages for which it is eligible with respect to the quarter.

-

Line 11c: Non-refundable portion of employee retention credit.

Use Worksheet 1 to calculate the amount of the employee retention credit for which it is eligible with respect to the quarter.

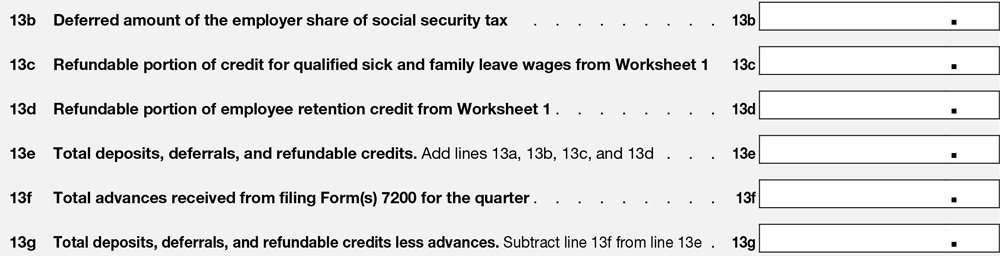

Part 1, Line 13 includes the new data fields below:

-

Line 13b: The deferred amount of the employer’s share of Social Security tax.

Report the amount of the employer share of social security tax that you chose to defer instead of depositing for the normal deposit deadlines in

the quarter. -

Line 13c: The refundable portion of credits for qualified sick-leave and family-leave wages.

After determining the combined nonrefundable credit for qualified sick leave wages and qualified family leave wages through using Worksheet 1, subtract the amount of the non refundable portion from the total amount of the combined credit to determine the amount of the refundable portion. Report the refundable portion of the combined credit identified in Line 2k of

the worksheet. -

Line 13d: The refundable portion of employee retention credit.

After determining the nonrefundable employee retention credit using Worksheet 1, subtract the amount of the nonrefundable portion from the total amount of the credit to determine the amount of the refundable portion. Report the refundable portion of the credit identified in Line 3k of the worksheet in Line 13d.

-

Line 13f: Total advances received from filing Forms 7200 for

the quarter.Report the total of the credit advances that you received through filing each Form 7200 filed for the quarter.

-

Line 13g: Total deposits, deferrals, and refundable credits

less advances.Subtract Line 13f from Line 13e and enter the result.

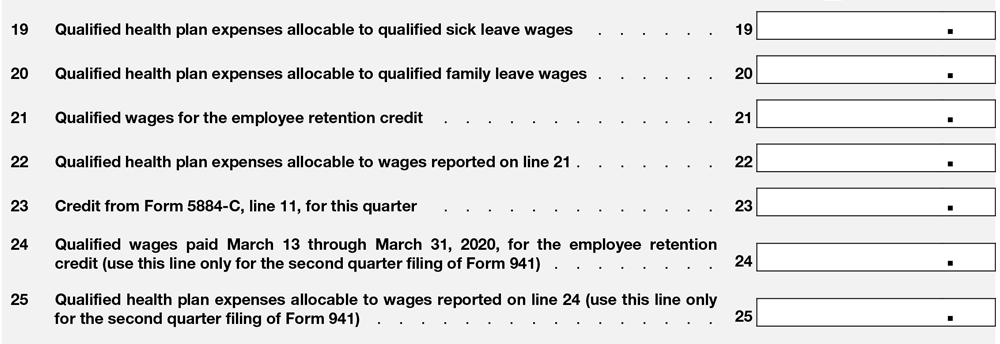

Part 3 has these new data fields:

-

Line 19: Qualified health plan expenses allocable to qualified sick-leave wages.

Report the amount of qualified health plan expenses incurred for maintaining group health plan coverage for employees receiving qualified sick leave wages.

-

Line 20: Qualified health plan expenses allocable to qualified

family-leave wages.Report the amount of qualified health plan expenses incurred for maintaining group health plan coverage for employees receiving qualified family leave wages.

-

Line 21: Qualified wages for the employee

retention credit.Report the amount of qualified wages factored into determining the amount of the employee retention credit for which you're eligible.

-

Line 22: Qualified health plan expenses allocable to wages reported for employee retention credit.

Report the amount of qualified health plan expenses incurred for maintaining group health plan coverage for employees who were paid qualified wages that were factored into calculating the employee retention credit.

-

Line 23: Credit from Form 5884-C, Qualified Tax-Exempt Organizations Hiring Qualified Veterans.

Report the Section 3111(e) credit for employment of qualified veterans, which is also reportable on Line 11 of Form 5884-C.

-

Line 24: Qualified wages paid between March 13 through March 31, 2020, to be used only for second-quarter filing.

Since the employee retention credit is available for qualified wages paid from March 13 to Dec. 31, 2020, and the period from March 13 to 31 was in the first quarter and the revisions to Form 941 were not ready for that quarter, you can report the information regarding qualified wages paid between March 13 and 31 for the employee retention tax credit using the second-quarter Form 941.

-

Line 25: Qualified health plan expenses allocable to qualified wages paid between March 13 through March 31, 2020, to be used only for

second-quarter filing.Report the amount of qualified health plan expenses incurred for maintaining group health plan coverage for employees who were paid qualified wages that were factored into calculating the employee retention credit for the first quarter.

3. Determining Credit

For businesses that are eligible for tax credit under the CARES Act or the FFCRA, the next step is to determine the credit amount. Employers can use Worksheet 1 to calculate the eligible credit amount.

This worksheet provides 3 steps for determining credits, but employers only need to complete the ones that apply to their business.

- Determine the employer share of social security tax for the quarter after-credits claimed on Form 8974 or

Form 5884-C. - Calculate sick and family leaves.

- Calculate Employee Retention Credit.

Employers can drop Step 2 or Step 3 if they did not pay qualified wages in

those categories.

E-file Form 941 in less than 5 minutes

Employers can e-file Form 941 easily with ExpressEfile by following a few simple steps. Just enter the required information, review the form, and transmit it directly to the IRS. The whole process takes only a few minutes.

ExpressEfile offers the lowest price of $5.95 for

filing Form 941.