Benefits of Filing Form 1099-MISC Online With ExpressEfile

Below are the best benefits you’ll get when you E-file Form 1099 through ExpressEfile.

Instant Filing Status

Get instant email notifications on the return status as soon as the IRS processes your

1099-MISC returns.

In-built Error Check

Our in-built audit check

will analyze your tax

return for basic errors,

so there is a lesser chance

of rejection.

Postal Mailing

Opt for the postal mailing option and let us send the copies of Form 1099-MISC to your recipients on

your behalf.

Email Copies

Send the return copies to

your returns by email

easily right from the application at no

additional charge.

File with confidence

How to File Form 1099-MISC Online?

Filing Form 1099-MISC online is so easy. You just have to follow the simple steps below.

Enter Information

Enter the 1099 form 2023 information such as payer and recipient info, miscellaneous payments made to the independent contractor.

Review Form

Review the draft form and make sure the information entered is correct. Update the information if you find

any mistakes.

Transmit the Return to IRS

If you find no mistakes, simply transmit the return to the IRS. You can then download or email the return copies from the application.

Start E-filing Form 1099-MISC. It takes less than 5 minutes.

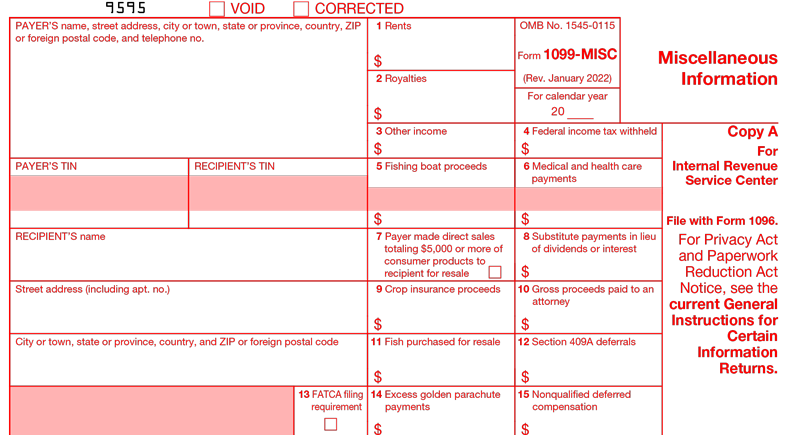

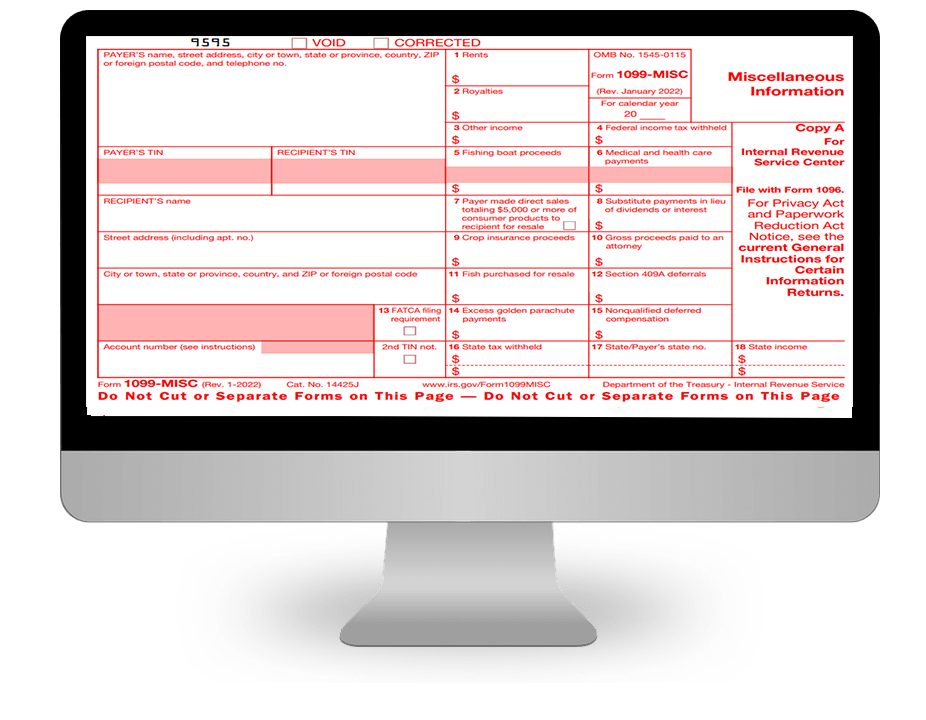

Information Needed to E-File Form 1099-MISC

Here are the details required to file Form 1099-MISC online:

- Payer Details: Name, EIN, and Address

- Recipient Details: Name, EIN /SSN, and Address

- Federal Filing Details: Miscellaneous Income and Federal Tax Withheld (if any)

- State Filing Details: State Income, Payer State Number, and State Tax Withheld

If you have the above information ready, start filing Form 1099-MISC online.

E-File 1099-MISC Now

Customer Testimonials

Make the smart choice of e-filing with ExpressEfile

Frequently Asked Questions on Form 1099-MISC

Who must file Form 1099-MISC?

Payers who made miscellaneous payments of $600 or more to independent contractors in a calendar year must file Form 1099-MISC. The miscellaneous payments include rent, fishing boat proceeds, medical and health care payments, prizes, and awards.

When is the deadline to file Form 1099-MISC?

The due dates for 2023 Form 1099-MISC are as follows:

- Due to send recipient copies: January 31, 2024.

- Filing deadline for paper filing: February 28, 2024.

- Filing deadline for E-filing: April 1, 2024.

E-File Form 1099 with ExpressEfile and get the filing status instantly. Also, you can postal mail the recipient copies. E-File Now

Are there any penalties for filing Form 1099-MISC late?

Yes, the IRS will impose the penalties for not filing Form 1099-MISC. A penalty of $50 per form if you file Form 1099-MISC within 30 days after the deadline. In case you file the form after 30 days from the deadline, the penalty will be increased up to $100 per form.

The reasons for penalties include

- late filing

- filing 1099 paper form that's not machine-readable

- Using the form for the wrong year

- Not using the right copy of Form 1099-MISC

- Filing with incorrect or missing TIN or reporting incorrect information

Helpful Resources for Filing Form 1099-MISC

Ready to File Form 1099-MISC Online for the 2022 Tax Year?

E-File your Form 1099 MISC in minutes and postal mail recipient copies.

Pricing starts as low as $0.80/form