Form 941 Late Filing Penalty

Instructions on how to avoid the late filing penalties

E-File 941 Now!Form 941 Q2 Deadline is on

August 02, 2021

E-file 3rd quarter Form 941 for the lowest

price ($3.99)

with ExpressEfile. E-file Now

Penalties for failing to file Form 941

Updated on October 23, 2023 - 10:30 AM by Admin, ExpressEfile

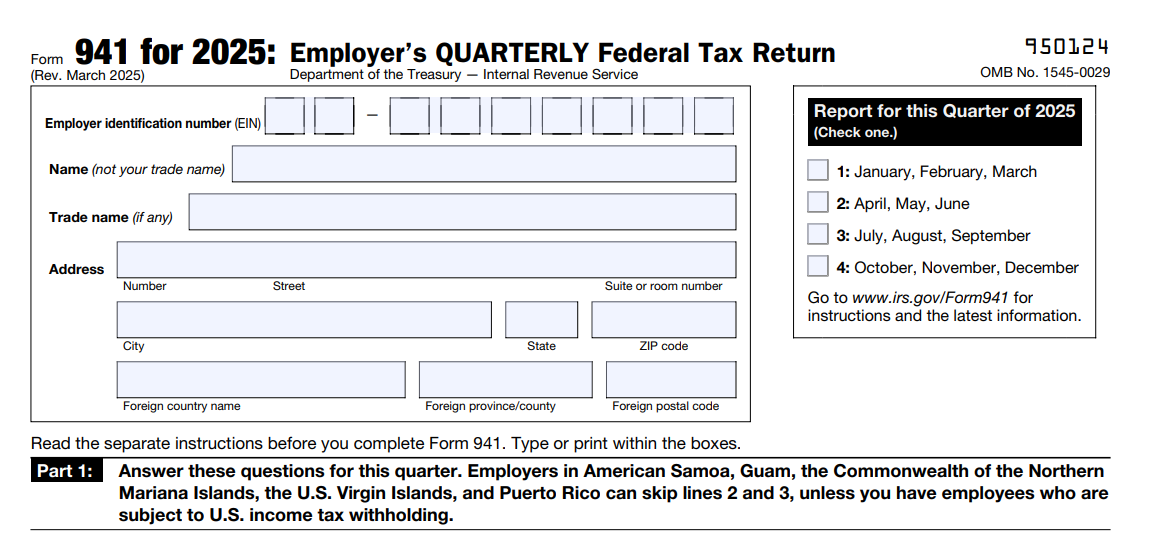

Form 941 is an employer’s tax return that needs to be filed every quarter. The deadline to file your Form 941 is the last day of the month following the quarter. If you do not file your Form 941 return or do not pay the required taxes within the deadline, the IRS will impose penalties. Check out the following topics to know about the penalties imposed due to Form 941 by the IRS.

1. Penalties for not filing 941

You will be subject to penalties if you fail to file your Form 941 within the filing deadline. The penalties for not filing Form 941 on time are as follows.

- A penalty of 5% of the total tax due.

- An additional 5% of the total tax due for each month the filing is due until it reaches 25%.

- If you do not pay the owed tax bill, you will be charged a penalty of 0.5% of the tax due in addition to the penalty for not filing. This 0.5% will increase each month the tax is due. The penalty amount will increase to 1% of your tax due, 10 days after the IRS sends an intent to levy notice.

2. Fail to pay payroll taxes

If you fail to pay your balance tax dues within the

941 deadline, you will receive a CP161 notice from the IRS regarding your penalties.

The penalty imposed will depend upon the tax amount owed and how late the payment was.

3. Penalty Calculator

The penalties for not filing your tax dues on time are as follows.

| No. of Days the payment delayed | Penalty Rate |

|---|---|

| One to five days | 2% |

| Six to fifteen days | 5% |

| 10 Days After Receiving Notice from IRS | 15% |

4. How to Avoid IRS 941 Penalties and Interest?

Here’s what you can do to avoid penalties and interest from the IRS.

- Pay the full tax amount you owe within the deadline.

- Complete your Form 941 on time.

- Report your tax liability accurately.

- Submit valid checks for payment of taxes.

- Provide accurate Form W-2 to your employees.

- File Form W-3 and Copy A of Forms W-2 with the SSA on time.

You can avoid paying the penalties if you plan ahead of your deadline and file your Form 941 and pay the required taxes within the quarterly deadline.

If you can show a reasonable cause as to why you haven’t filed Form 941 or paid the required taxes within the deadline, the IRS might consider waiving your penalties.

The IRS has revised Form 941 for Q2, 2021. The American Rescue Plan Act of 2021 (ARP), signed into law on March 11, 2021, includes relief for employers and their employees during COVID-19. As always employers need to report COVID-19 credits on Form 941, so the IRS has updated the form to reflect the ARP.

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $5.95 for filing Form 941.

E-File 941 Now