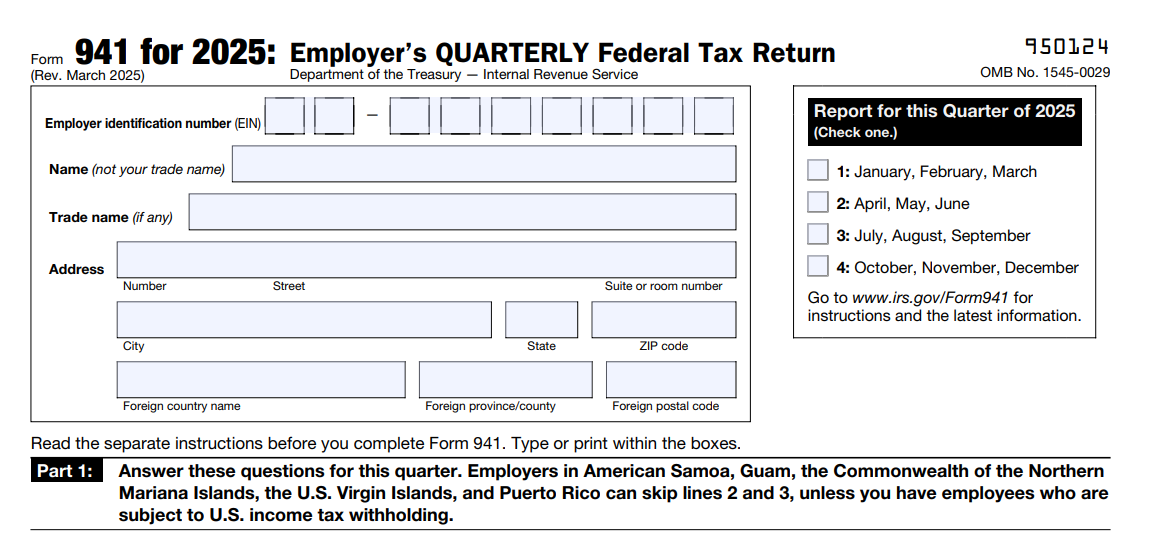

Form 941 - Employer’s Quarterly Federal

Tax Return

E-File 941 Now!

Form 941 Q2 Deadline is on

August 02, 2021

E-file 3rd quarter Form 941 for the lowest

price ($5.95)

with ExpressEfile.

E-file Now

IRS Form 941 - Definition, Purpose, and

Due Dates

Updated on June 11, 2021 - 10:30 AM by Admin, ExpressEfile

IRS Form 941, is a quarterly Form that any business owner with employees must file it with the IRS. The IRS has officially named this form as Quarterly Employer’s Federal Tax Return. As the title implies, this form must be submitted to the IRS on a quarterly basis to report tax liability.

The following are the topics covered under this article:

1. What is Form 941?

The IRS Form 941, Employer’s Quarterly Federal Tax Return, used by businesses to report information about taxes withheld such as federal income, FICA taxes, and additional tax medicare tax withheld from the employee wages with the equivalent employer contribution.

Along with efiling your tax return with the IRS, you can also make a quarterly tax payment.

File your 2023 Form 941 accurately. IRS compares the amounts on your Form 941 with your annual Form W-3, Transmittal of Wage and Tax Statements.

The IRS has revised Form 941 for Q2, 2021. The American Rescue Plan Act of 2021 (ARP), signed into law on March 11, 2021, includes relief for employers and their employees during COVID-19. As always employers need to report COVID-19 credits on Form 941, so the IRS has updated the form to reflect the ARP.

2. Instructions For Filing Form 941

When it comes to filing, employers have two options. Either they can choose to go with the traditional paper filing methods or electronic filing. While both the methods are accepted by the IRS, it is highly recommended to file 941 return electronically to process it quickly. This is a more convenient method for the IRS and more convenient for the filer as well.

Did you know that in general, forms that are paper-filed with the IRS are nearly 40% more likely to have mistakes?

Filing electronically allows you to be more aware of any errors during the process and the transmission is much smoother as well.

There are several bits of information that you should have at your disposal. Including…

- Your basic business information (name, address, EIN)

- Your total employee count

- Medicare and Social Security withholding information

- Tax Deposits made to the IRS

- Your tax liability for the quarter ended

Visit https://www.expressefile.com/e-file-form-941-online/ to learn more about Form 941 filing.

3. Exceptions for Filing Form 941

There are a few exceptions to the rule when it comes to Form 941 filing. While the vast majority of employers who employ workers will have to file this form, and there are a few specific situations where another form is required instead.

Individuals who employ workers in their homes are generally not expected to file this form.

Seasonal employers are not required to file Form 941 every quarter, they may not have employees or pay wages during the quarters when they are not doing business.

Employers who are in the agriculture industry are required to file a different form. Form 943 refers specifically to employers in the agricultural industry and their workers.

4. Small Business Tax Credit

In addition to filing your Form 941, you may be interested in the small business research tax credit. The IRS officially named this form the Qualified Small Business Payroll Tax Credit for Increasing Research Activities. This is also referred to as Form 8974.

If you are choosing an E-file provider for your Form 941 filing, first be sure that they are IRS authorized, then be sure that they have the capability to file this form. Not all providers offer the electronic transmit of this form and that will become a complication if you want to apply for this tax credit.

Visit https://www.expressefile.com/e-file-form-941-online/ to e-file your Form 941 2022 & 2023 with the IRS.

5. IRS Form 941 2023 Deadlines

The Form 941 has four separate deadlines.

First Quarter

( January, February, March)

Second Quarter

(April, May, June)

Third Quarter

( July, August, September)

Fourth Quarter

(October, November, December)

Please note that when any IRS deadline lands on a weekend day or a national holiday, the deadline is automatically pushed to the next business day. For example, if the deadline falls on a Saturday, your deadline to file will be the following Monday.

Get 10 days extension: If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter.

6. Determining Your Deposit Schedule

The IRS determines your business’ deposit schedule based on your tax liability. This will determine whether you are a monthly or semiweekly depositor. Here are the general rules when it comes to the IRS deposit schedule.

- If your business has tax liability totaling less than $50,000, then the IRS considers you a monthly depositor.

- If your business has tax liability totaling more than $50,000, the IRS considers you a semiweekly depositor.

- Semi-weekly depositors will be required to file the Schedule B and attach it to Form 941.

Visit https://www.expressefile.com/free-fillable-form-941-schedule-b/ to learn more about Form 941 Schedule B.

7. What Are The Penalties Associated with Form 941?

The penalties for Form 941 may seem minor compared to other forms, but they will end up with a huge penalty if the payments or filing was not done on time.

For each month that you are late filing your Form 941, the IRS will charge you a 5% penalty. This amount is based on your unpaid tax. The IRS will charge you a maximum penalty of 25%.

The IRS also adds on an extra .5% tax for every month that your filing is late.

8. How to Avoid IRS Penalties?

You can avoid IRS penalties pretty easily by being proactive. Be sure that you file Form 941 correctly and pay your outstanding taxes on time. You should also make sure that you are reporting your tax liability as accurately as possible. It is also very important that you file accurate W-2 Forms with both your employees and the SSA.

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $5.95 for filing Form 941.

E-File 941 Now!