Complete Schedule B (Form 941) Online and E-file it with the IRS

Enter, E-file, and Download Forms Instantly

E-File Form 941 NowEasily e-file IRS Form 941 for just $4.95,

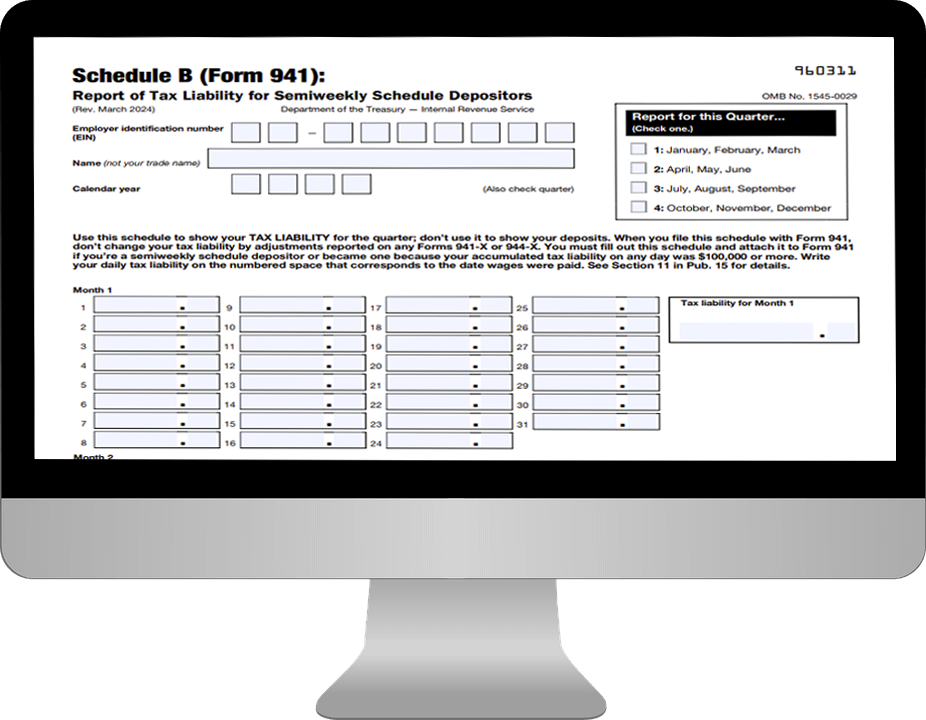

What is Form 941 Schedule B?

Form 941 Schedule B must be filed by employers along with Form 941 or 941-SS if they are a semi-weekly depositor or have accumulated $100,000 or more in tax liabilities on any given day in the current or past calendar year.

An employer is considered to be a semi-weekly depositor of federal employment taxes for the entire calendar year if the aggregate amount of taxes reported on Form 941 is more than $50,000 in the look-back period (the total amount of employment taxes reported by the employer in the 12-month period preceding June 30th).

For example, the look-back period to submit employment tax deposits in 2021 would be the 12-month period from

July 1, 2019 to June 30, 2020.

How to Complete Schedule B with Form 941?

-

STEP 1

Enter required details such as business information, wages paid to employees and taxes withheld during the quarter

Select semiweekly schedule depositor under Part 2 - Line 16, and Schedule B will be enabled for you to fill.

-

STEP 2

Review the draft version of Form 941 and make sure you provided the accurate information

-

STEP 3

If the information provided is accurate, transmit the return directly to the IRS. You'll receive an email once the IRS processes your return.

File Schedule B with Form 941 in Minutes

E-file your Form 941 along with Schedule B in just a few clicks with the IRS for just

$4.95 per form.

It’s free!

Looking to Download Schedule B (Form 941)?

- Just fill in your Form 941 information.

- Enter Schedule B (Form 941) information.

- Download Form 941 along with Schedule B for free!