Create Fillable and Printable Form 1099-MISC Online for 2021

- Fill, E-file, Download or

Print Forms - Quick & Secure Online Filing

- Instant Filing Status

- Postal Mail Recipient Copies

Pricing starts as low as $2.75/form

Simplify Your Form 1099-MISC Online Filing with ExpressEfile!

Lowest Price

Pay only $2.75/form,

the lowest price in the

industry, to e-file 1099-MISC directly with the IRS. No

hidden charges

Form Validation

Get your forms scanned and validated for basic errors and ensure that you have transmitted returns error-free to the IRS.

Instant Notifications

Receive notifications about the filing status by email once the IRS processes your Form 1099-MISC. You may also check the status right from your account.

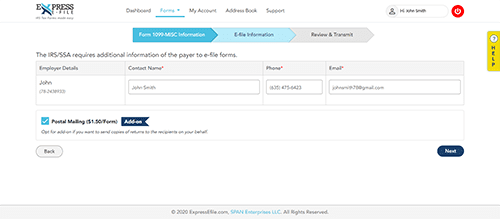

Mail Recipient Copies

Save your time and

money in sending your

recipient copy. Choose

ExpressEfile to mail copies to

your recipients.

What is Form 1099-MISC?

IRS Form 1099-MISC is filed by payers to report miscellaneous payments of $600 or more made to independent contractors during the tax year. The miscellaneous payments include rents, proceeds to an attorney, fishing boat proceeds, prizes, rewards, etc.

When is Form 1099-MISC due?

Form 1099-MISC has 3 different deadlines. Below are the deadlines of Form 1099-MISC for the 2021 tax year:

- Sending recipient copy deadline: February 15, 2022

- Paper filing deadline: March 01, 2022

- E-filing deadline: March 31, 2022

What are the different copies available for Form 1099-MISC?

A payer requires to distribute the copies of Form 1099-MISC as follows:

- Copy A—For Internal Revenue Service

- Copy 1—For State Tax Department

- Copy B—For Recipient

- Copy 2—To be filed with recipient's state income tax return, when required.

- Copy C—For Payer

How to complete Form 1099-MISC using ExpressEfile?

Filing Form 1099-MISC with ExpressEfile is easy and can be done in minutes. Get started now and complete your filing.

Expressefile, an IRS authorized e-file provider, offers the fastest way to complete your information returns such as Forms 1099-MISC, 1099-NEC, and W-2 with the IRS and SSA.

Please follow the step-by-step instructions below to complete and file your Form 1099-MISC with the IRS.

-

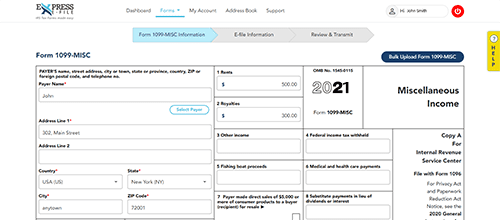

Step 1: Enter Form 1099-MISC Information

Sign up with ExpressEfile and select Form 1099-MISC from the list of supported forms. Start filling out the form information as filling out in a physical form. Make sure you have all the required information to complete the filing.

-

Step 2: Review Form 1099-MISC

Our built-in audit check will validate your return based on the IRS business rules and prompt you to correct the errors if there are any. Then, preview your draft Form 1099-MISC and ensure the information entered is correct. If there are any, update the information.

-

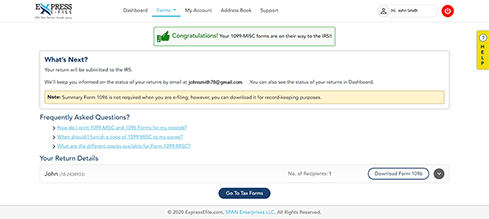

Step 3: Transmit Form 1099-MISC to the IRS

After reviewing the draft form, proceed to transmit the form to the IRS. You will receive an email once the IRS processes your return.

What is the penalty for not filing Form 1099-MISC?

The IRS will impose a penalty under section 6721 for not filing Form 1099-MISC by the due date. The following are the penalty rates.

- A penalty of $50 per form will be imposed if you file Form 1099-MISC within 30 days of the due date.

- And, you will be charged a penalty of $100 per form if you file Form 1099-MISC after 30 days of the due date.