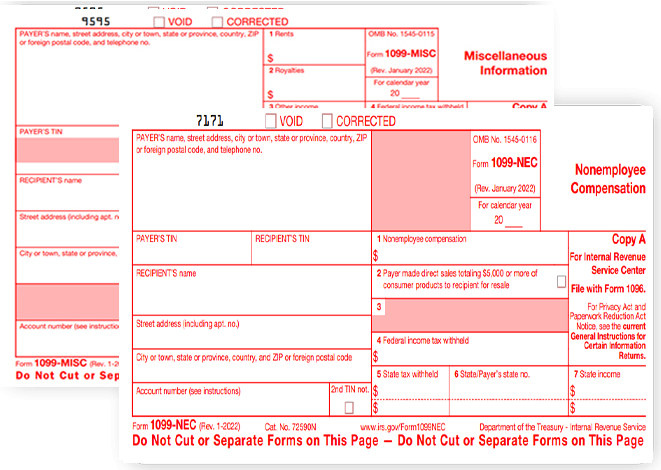

E-File 1099-NEC or 1099-MISC

Correction Form

- Correct Form 1099-NEC or MISC

in Minutes - Postal Mail Corrected Copies

- Download & Print Form Copies

- Form 1096 will be generated for

your reference

Pricing starts as low as $0.80/form

Benefits of filing 1099 Correction Form Online

with ExpressEfile

Correct 1099 in Minutes

Correct your Form 1099s

in a few minutes

with

the help of our easy

flow and

step-by-step instructions.

Postal Mail

Corrected Copies

Let us postal mail the corrected 1099 online form copies to your recipients on your behalf while

filing corrections.

Download & Print

Form Copies

Access the corrected Form 1099 copies at any time from the print center to download and print for

your records.

Get 1096 for free

Get your Form 1096 updated with no additional charges. Access the form copy anytime and keep it for

your records.

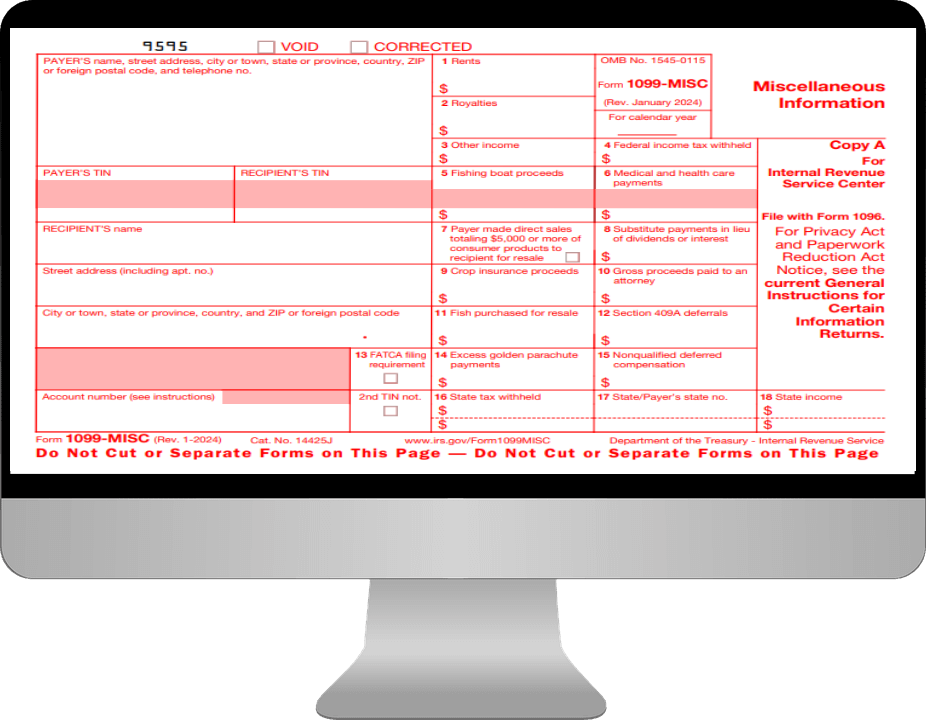

What information can be corrected in Form 1099?

Below are the details that can be corrected in a 1099 return:

- Payer information such as name, TIN, and address (You will need to send a letter to the IRS. Learn more.)

- Recipient information such as name, TIN, and address

-

Amounts reported in the return

- For 1099-MISC, boxes 1 to 17, including rents, royalties, federal income tax withheld, state information, etc.

- For 1099-NEC, boxes 1 to 7, i.e., nonemployee compensation, federal income tax, and state information.

If you are not required to file 1099 return but filed it, you will have to void the return.

How to Correct Form 1099 Online?

Filing 1099 correction forms with ExpressEfile takes only a few minutes. Follow the steps below to file corrections for 1099 forms.

Choose the type of correction

Choose whether you want to file a correction form or void a form that was already filed.

Enter the corrected information

Enter the information that needs to be corrected in the respective fields.

Review & Transmit

to IRS

Review the form to make sure you have entered the correct information and transmit it to the IRS.

Frequently Asked Questions on Form 1099 Corrections

When is the deadline for filing 1099 corrections?

There is no specific deadline to file 1099 correction forms; however, you have to file corrections as soon as you find the mistakes in your returns. Also, you will need to send the corrected copies to your recipients.

Note: If you are correcting the information related to state, you will have to file with the state. DO NOT file with the IRS.

What should I do if I filed Form 1099-MISC instead of 1099-NEC or 1099-NEC instead of 1099-MISC?

If you are required to file a 1099 form for a recipient but filed a different 1099 form (1099-MISC instead of 1099-NEC or vice versa) for them, you will need to void the originally filed return and file a new 1099 form. With ExpressEfile, you can void the filed return and file Forms 1099-NEC and 1099-MISC.

What state information can I correct on Form 1099?

You can correct the following state errors on Form 1099:

- State tax withheld

- State/Payer’s state number

- State income

Errors that apply only to state filing requirements should be filed directly

with the state.

How do I correct a recipient information in my 1099 form?

You can easily correct Form 1099 (MISC and NEC) through ExpressEfile. You just have to choose the type of correction, that is, recipient info or the amount reported, and update the correct information. You can then preview the return and transmit it to the IRS. Click here to know the step-by-step instructions,

Is there any penalty for filing 1099 forms with incorrect information?

The IRS may impose a penalty of $310/return for failure to include all of the information required to be shown on the return or the inclusion of incorrect information. The 1099 penalties will increase up to $3,783,000 for a

calendar year.

Ready to E-File 1099 Correction Form with ExpressEfile?

E-File the corrected 1099 in minutes and postal mail the copies.

Pricing starts as low as $0.80/form