Form 941 First Quarter Deadline is April 30, 2024.

E-File Now

Form 1099-NEC Late

Filing Penalty

This article covers the following topics:

E-File Form 1099-NEC Now

Penalties for failing to file Form 1099-NEC

Updated on November 08, 2024 - 1:30 AM by Admin, ExpressEfile

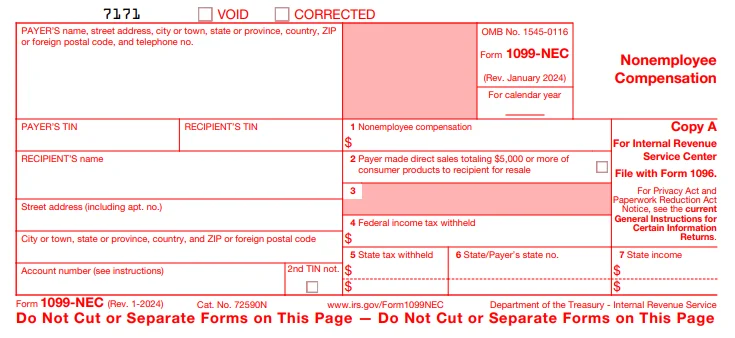

The IRS introduced a new form,

Form 1099-NEC, to report nonemployee compensation from the 2024 tax year. Payers who have paid at least $600 as compensation to contractors or nonemployees must file this form. Missing to file the return may result

in penalties

Read on to learn more about Form 1099-NEC penalties and how to

avoid it.

1. Penalties for not filing Form 1099-NEC?

Your business can be penalized for forgetting to

file Form 1099-NEC, providing inaccurate information, failing to provide all the required information, and filing after

the deadline.

The deadline for filing Form 1099-NEC with the IRS and sending recipient copies for the 2024 tax year is Jan 31, 2025.

The penalties for missing the Form 1099-NEC deadline get more expensive the longer employers wait to file. The later a return is, the more your business will owe the IRS.

|

If you file Form 1099-NEC |

||

|

Within 30 days after after the deadline |

More than 30 days after the deadline, but before August 1 |

After August 1 |

|---|---|---|

$60 per information return |

$130 per information return |

$330 per information return |

If you run a small business with average gross receipts of $5 million or less for the 3 most recent tax years, the penalty amounts will be lower.

With ExpressEfile, you can easily

E-File Form 1099-NEC for the lowest price ($0.80/form). Complete your return in minutes and get your filing status instantly.

2. How to avoid penalties

The best way to avoid IRS penalties is to file Form 1099 NEC accurately and on time.

E-filing 1099-NEC is a great way to avoid missing and inaccurate information on Form 1099-NEC. ExpressEfile’s software checks your returns for mistakes, authenticating information, and finding discrepancies that could lead to IRS penalties. Employers can correct errors easily and transmit their returns directly to the IRS.

If your Form 1099-NEC is rejected for any reason, you will be notified instantly and be able to fix mistakes quickly and retransmit your return for free.

Sending out return copies is another important part of meeting your Form 1099-NEC deadline. When you select our postal mailing option, ExpressEfile sends copies to all your recipients on

your behalf.

3. E-File Form 1099-NEC in less than 5 minutes

ExpressEfile makes filing Form 1099-NEC online easy. Complete your return in minutes and get your filing status instantly. Follow these steps to meet your Form 1099-NEC deadline easily.

- 1. Enter your Information Easily

- 2. Review Your Form

- 3. Transmit Form 1099-NEC Directly to the IRS

Get the lowest price in the industry when you

e-file Form 1099-NEC for just $0.80 per form. Also, you can postal mail the recipient copies with the postal mailing option. e-file with the postal mailing option is available for $0.50/form.