File 941 Online Using IRS

Authorized Software

- Quick & Secure Online Filing

- Includes 941 Schedule B, 8974, 8453-EMP

- Built-in validations and auto calculations to save time

- Get Instant Status updates from the IRS

Don’t Miss Out – Save 10% on Your 941 Filing This Quarter!

New ‘Bundle Pricing’ for 941 Filers — and it's here to help you save more this year.

Filing 941s or 940? Grab the perfect bundle and unlock 10% savings instantly!

Why Choose This Bundle Pricing?

- Plan ahead for all 4 quarters — file stress-free!

- One-Time Purchase, Year-Round Filing!

- No need to re-enter card details every quarter

Bundle 1:

Includes 4 Form 941s & 1 Form 940

$29.75 $26.775

Bundle 2:

Includes 4 Form 941s

$23.8 $21.42

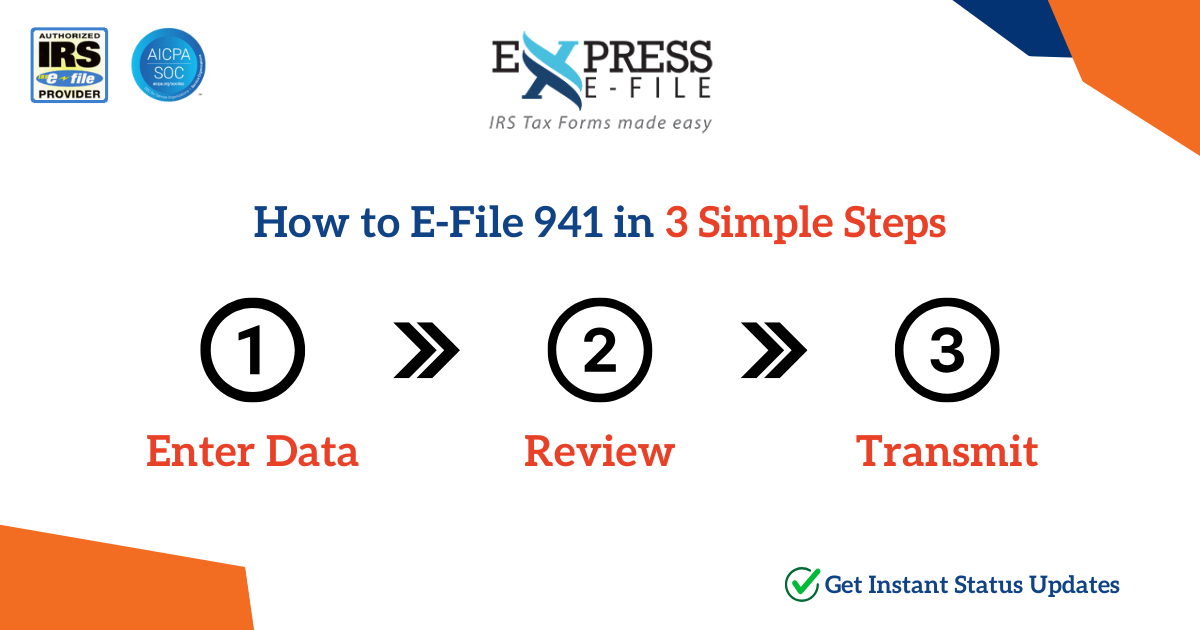

How to E-File Form 941 Online?

-

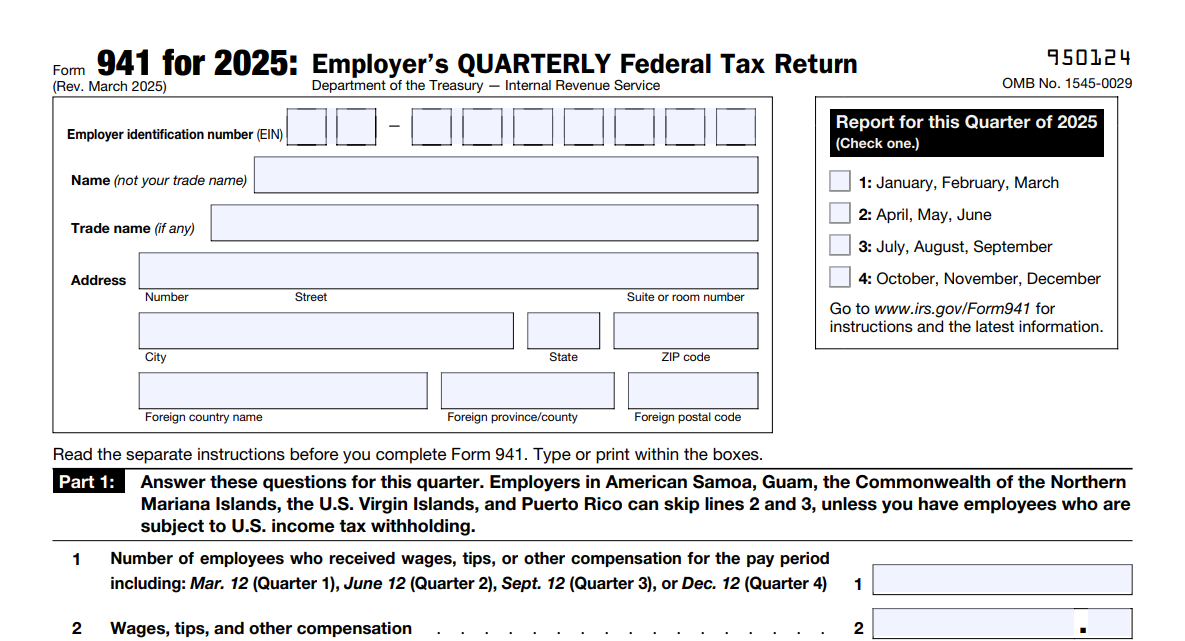

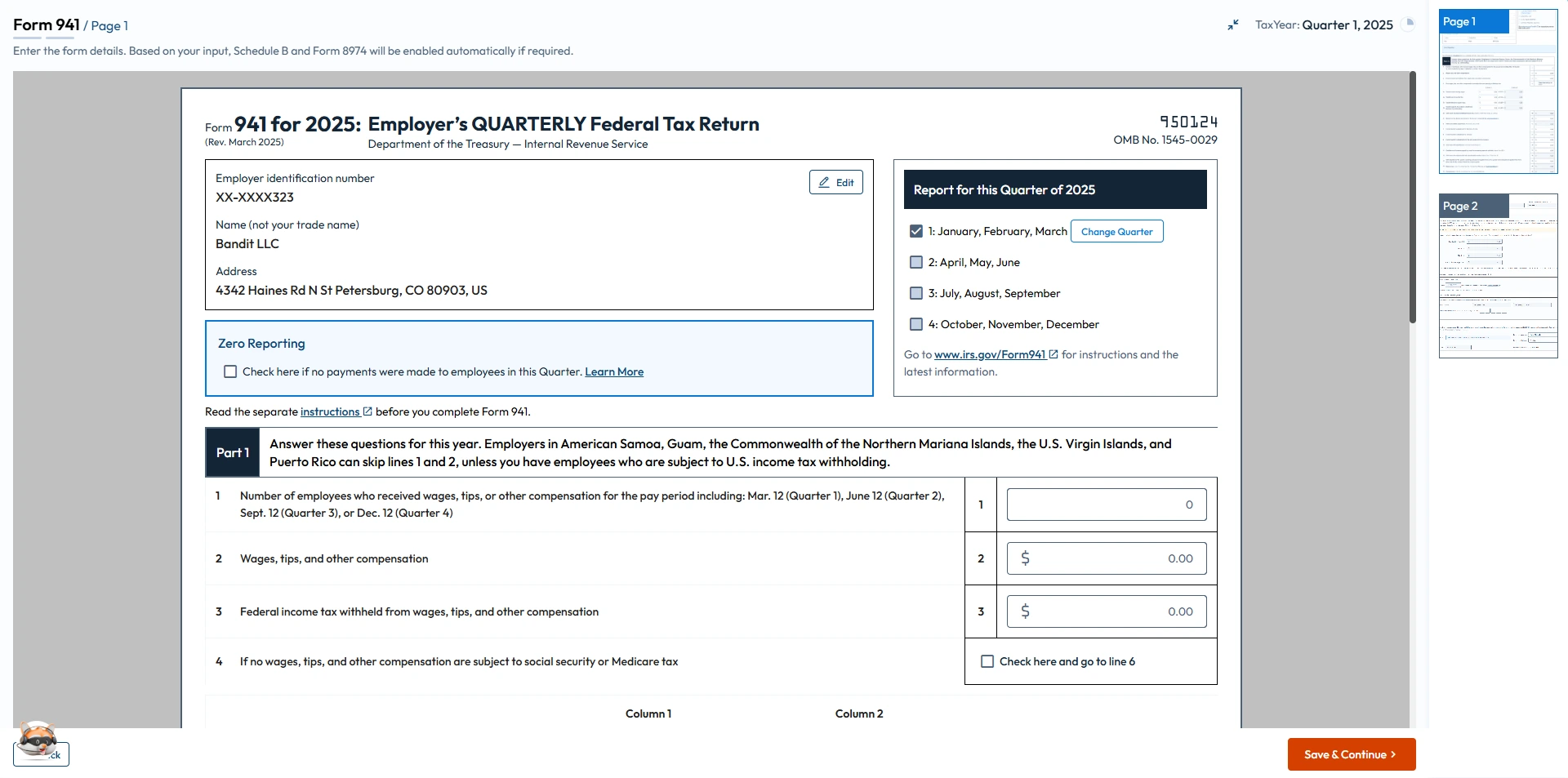

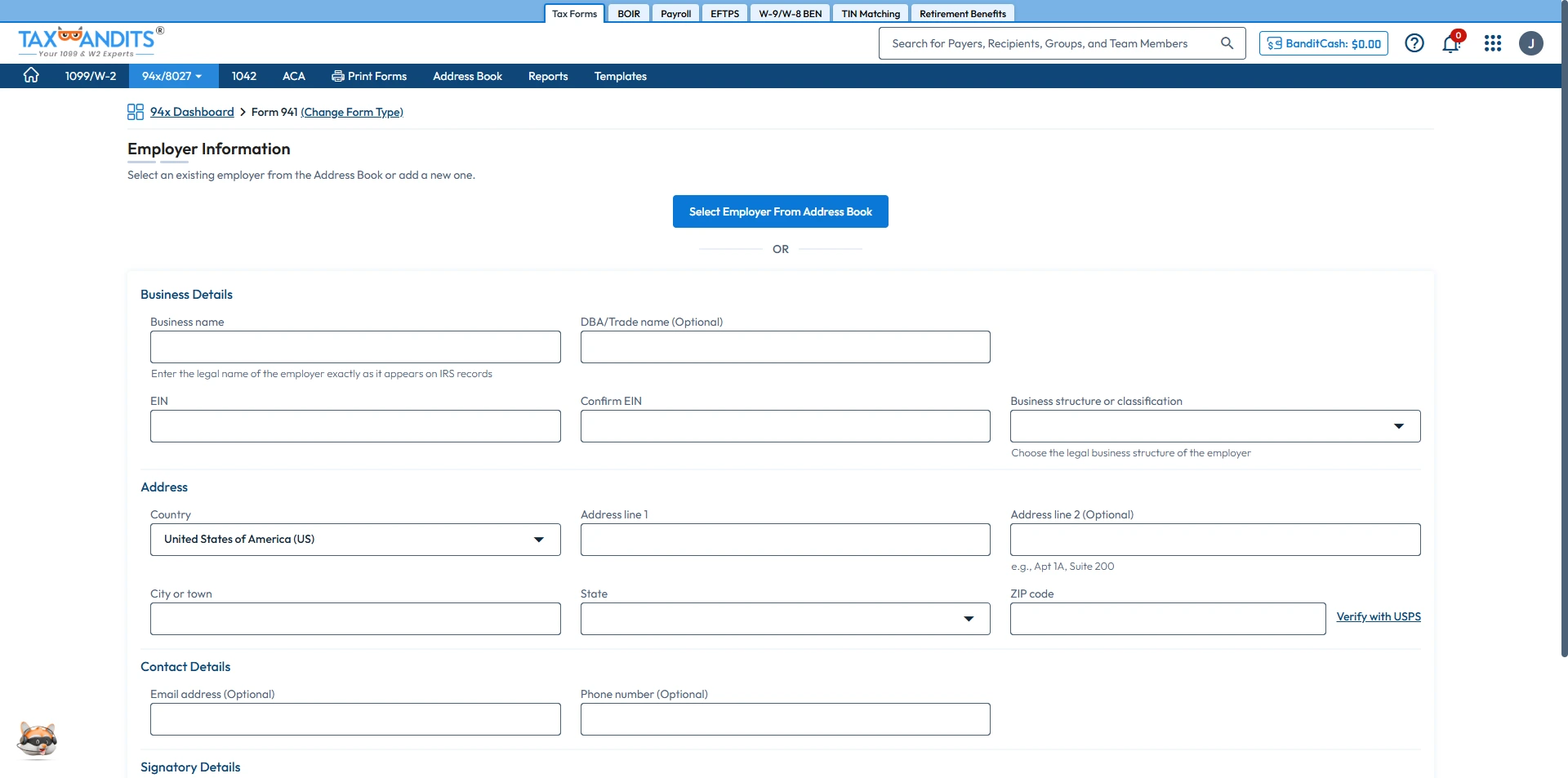

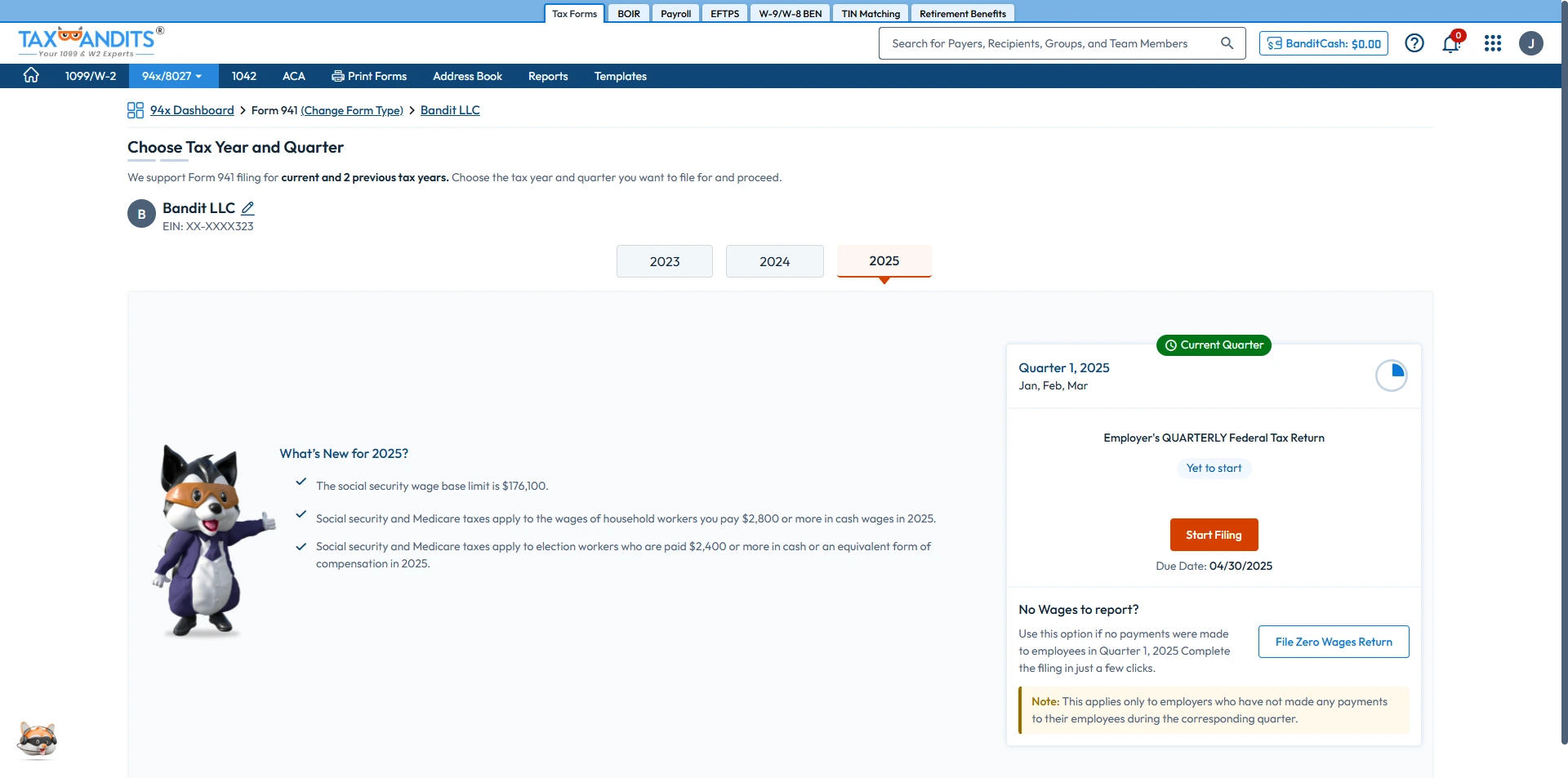

Step 1: Complete Form 941 Information

Choose the quarter and enter business information (EIN, Name, Business Name, and Address).

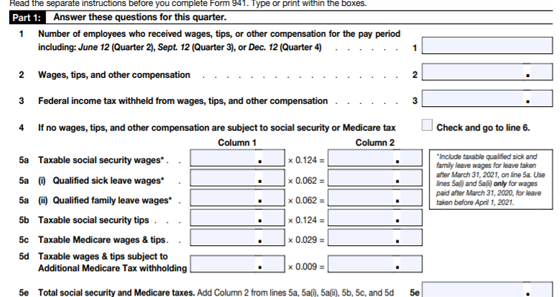

Enter employee count, wages, and taxes withheld.

-

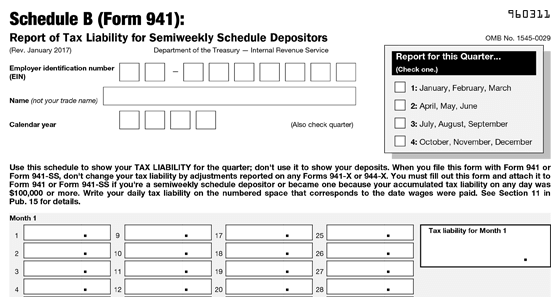

Step 2: Enter Deposit Schedule & Tax Liability

Enter the deposit schedule & tax liability for the quarter.

Note: Complete 941 Schedule B and Form 8974 if required.

-

Step 3: Pay IRS Balance Due if any

Our software will allow you to pay the balance due to the IRS using multiple payment options such as EFW, EFTPS, Credit Card / Debit Card, and check or money order. Choose the IRS payment option of your choice and pay your balance due.

Note: You can now make federal tax payments using TaxBandits EFTPS Payment Solution. If you choose to pay using EFTPS, make sure to pay the balance due prior to the deadline. If you choose to pay the balance due through check or money order, you have to mail Form 941-V to the IRS. You can download Form 941-V, once you e-file Form 941 with the IRS.

-

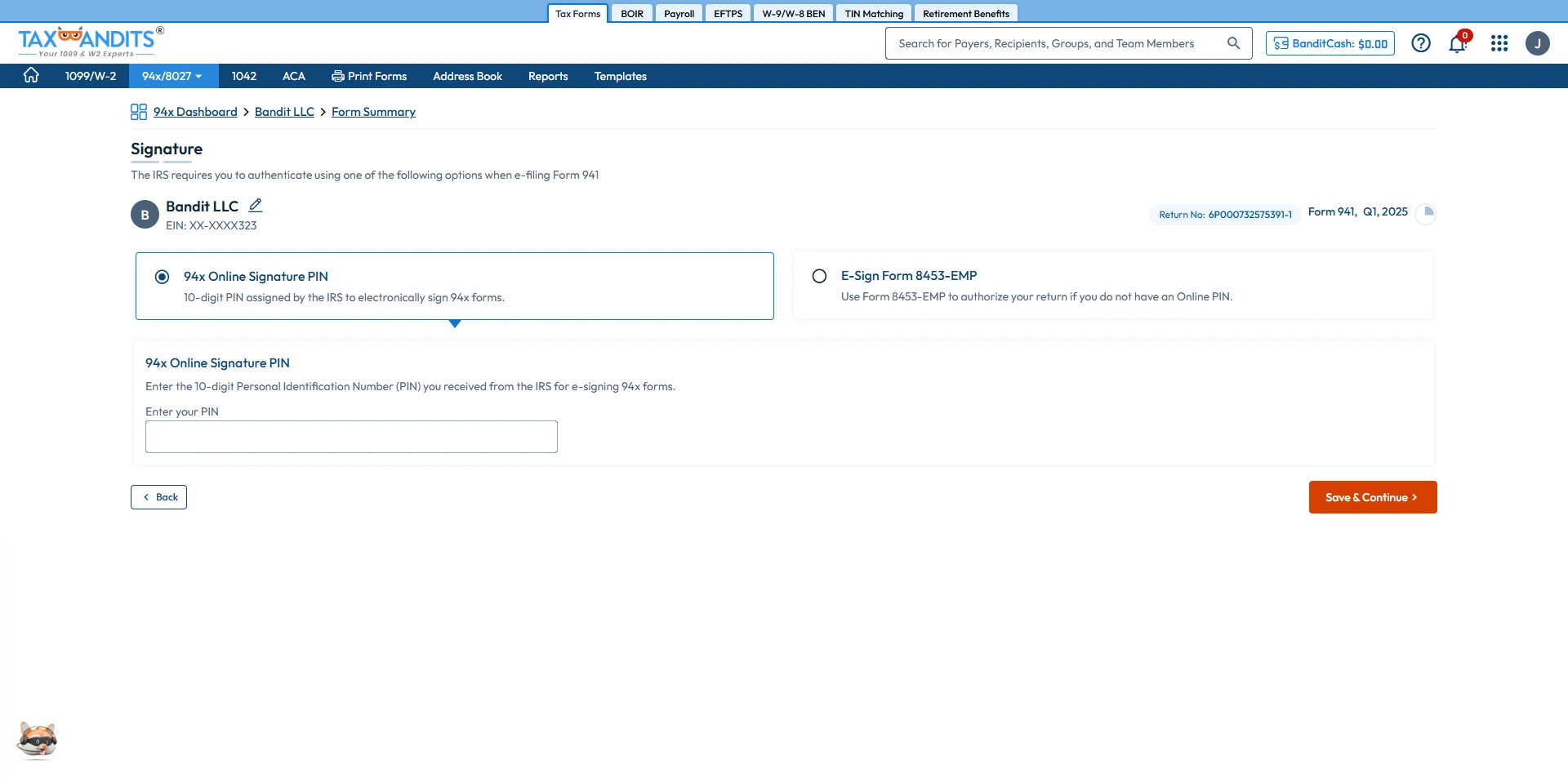

Step 4: Sign Form 941

In order to complete the 941 filing, you must sign Form 941 using Form 8453-EMP or 94x Online Signature PIN.

If you have an online signature PIN you can enter your 5-digit PIN, or you can use Form 8453-EMP to sign and approve your Form 941.

-

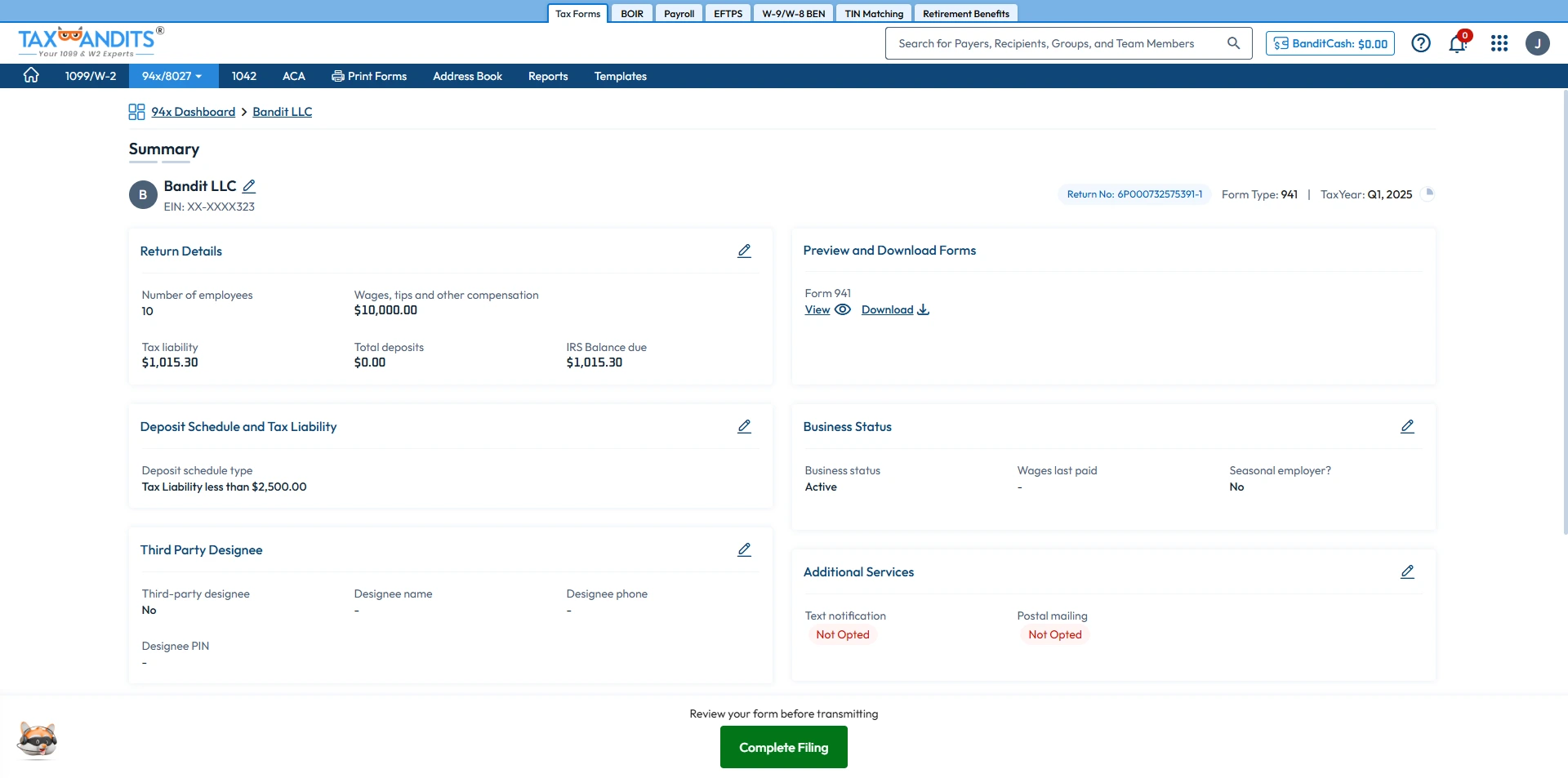

Step 5: Review & Transmit to the IRS

The final step is to review your form summary before transmitting it to the IRS. Our built-in error check will make sure that the return is error-free.

You can edit any form information if required and then transmit your return to the IRS.

Are you ready to File 941 Online?

Features to Simplify your Form 941 Online Filing!

Schedule B (Form 941)

You can attach Form 941 Schedule B to report tax liability and semiweekly deposit schedule for Free.

Bulk Upload your data Using Excel

Use our 941 bulk upload template and reduce the time in manually uploading your data.

Make EFTPS Payments using TaxBandits

TaxBandits now offers EFTPS payments, streamlining your federal tax payment process directly through their platform.

Signature Options

You can either use our built-in Form 8453-EMP to e-sign your Form 941 or use a 94x online signature PIN to authorize your return.

File Form 941 Online with us and Get Instant Status Update from the IRS.

E-File Form 941 NowWhat are the Changes in Form 941 for the 2025 Tax Year?

The IRS has recently revised Form 941 for 2025. Accordingly, the following changes have been made to the Form 941 for 2025:

- The Social Security wage base limit is now been increased for 2025.

- For household and election workers, the FICA tax withholding requirements are updated.

- The IRS has now introduced the e-filing option for Form 941 corrections (Form 941-X).

For a more detailed explanation of these updates, check out this comprehensive blog:

When is the deadline to File Form 941 for 2025?

The deadline to file form 941 is the last day of the month following each quarter. You need to File 941 Tax Form four times every year.

First Quarter

April 30,

2025

Second Quarter

July 31,

2025

Third Quarter

October 31,

2025

Fourth Quarter

January 31,

2026

File 941 Online before the Deadline to avoid penalties.

E-File 941 NowWhy Choose ExpressEfile to File 941 Electronically?

IRS-authorized 941 E-file Provider

Easy-to-use User Interface

Review Form Summary

Lowest Price in the Industry

Accurate Calculations

Make Corrections Before Filings

Instant IRS Filing Status

Built-in Error Check

Download & Print Forms

Simplify your E-file 941 Process with Time-saving Features.

Get Started NowComplete and File Form 941 online at just $5.95/ Form

Simple, Quick & Easy. It takes only less than 5 minutes.