Form 941 Schedule B

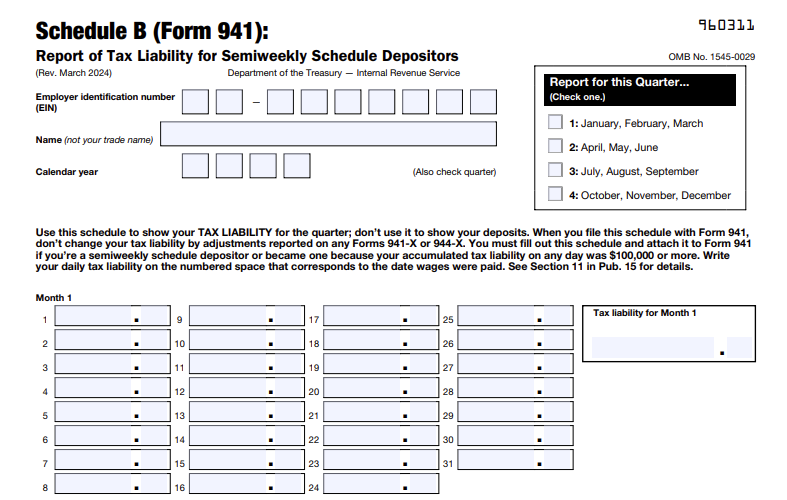

Report of Tax Liability for Semiweekly Schedule Depositors

Last Updated:

June 11, 2025

Form 941 Schedule B: An Overview

Form 941 Schedule B is a tax form for the reporting of tax liability for semi-weekly pay schedules. It is applicable to employers who fall under any one of the following:

- Reported employment taxes of $50,000 or more in the lookback period.

- Accrued tax liabilities of $100,000 or more on any given day in the current or prior tax year.

Read on to learn more about 941 Schedule B for 2025.

Table of Content

- What is IRS Form 941 Schedule B?

- How can I know if I need to complete Schedule B for Form 941?

- Why should you file Schedule B (Form 941)?

- How to complete Schedule B with Form 941?

- What are the changes in Form 941 for the 2025 tax year?

- When is the due date for filing Form 941 Schedule B?

- Penalty for not filing Schedule B (Form 941)?

1. What is IRS Form 941 Schedule B?

Form 941 Schedule B is used by semiweekly depositors to report the tax liability along with Form 941 which reports federal income taxes withheld from the employee's wages and employer and employee portion of social security and Medicare taxes. Every quarter the employer has to report the withholding information in Form 941 Schedule B.

Employers should not use Schedule B to show the federal tax deposit.

2. Which employers must use form 941 Schedule B?

If the employers satisfy the following tax liability categories, they must file Schedule B.

Reported employment taxes more than $50,000 in the lookback period or acquired $100,000 tax liability or more during any single day in the current or previous calendar year.

3. Why should you file Schedule B (Form 941)?

The Form 941 Schedule B helps the IRS verify you have have made timely deposits of the employment tax liabilities. If you are a semi-weekly schedule depositor and fail to make deposits on time, the IRS may impose an average Failure to Deposit (FTD) penalty.

4. How to complete Schedule B with Form 941?

You can complete Schedule (Form 941) in two different ways as follows:

You can file Form 941 and Schedule B electronically through IRS authorized e-file providers in a few minutes.

If you choose paper filing, complete Form 941 and Schedule B and mail it to the IRS.

You can easily attach Schedule B for free when you e-file Form 941. You’ll also get the filing status instantly. ExpressEfile offers the lowest price ($5.95). E-file Now

5. What are the changes in Form 941 for the 2025 tax year?

The IRS has revised Form 941 for 2025 which include changes as follows:

- The social security wage base limit has been updated for the 2025 tax year.

- Household and election employers should now follow the updated threshold for withholding FICA taxes from their employees.

- Correction on previously filed Form 941 can now be electronically filed using Form 941-X.

Visit https://blog.taxbandits.com/the-irs-released-form-941-for-2025-key-changes-and-updates-released-by-the-irs/ for more detailed information on changes in Form 941 for 2025.

6. When is the due date for filing Form 941 Schedule B?

There is no specific deadline fixed for filing Form 941 Schedule B by the IRS. However, it has to be filed with your Form 941 according to the quarterly deadline.

Visit https://expressefile.com/form-941-due-date to learn about the Form 941 due dates.

7. Is there any penalty if Form 941 Schedule B is not filed?

If you have failed to file 941 Schedule B, the IRS will not be able to calculate the exact penalty rates. Thus, the IRS will impose an average FTD penalty. It will be calculated based on the total tax liability reported in Form 941, line 12.

E-File Form 941 with ExpressEfile

ExpressEfile lets you E-file Form 941 easily and quickly. It takes only a few minutes to E-File your 941 directly with the IRS.

ExpressEfile offers the lowest price of $5.95 for filing Form 941.

E-File 941 Now