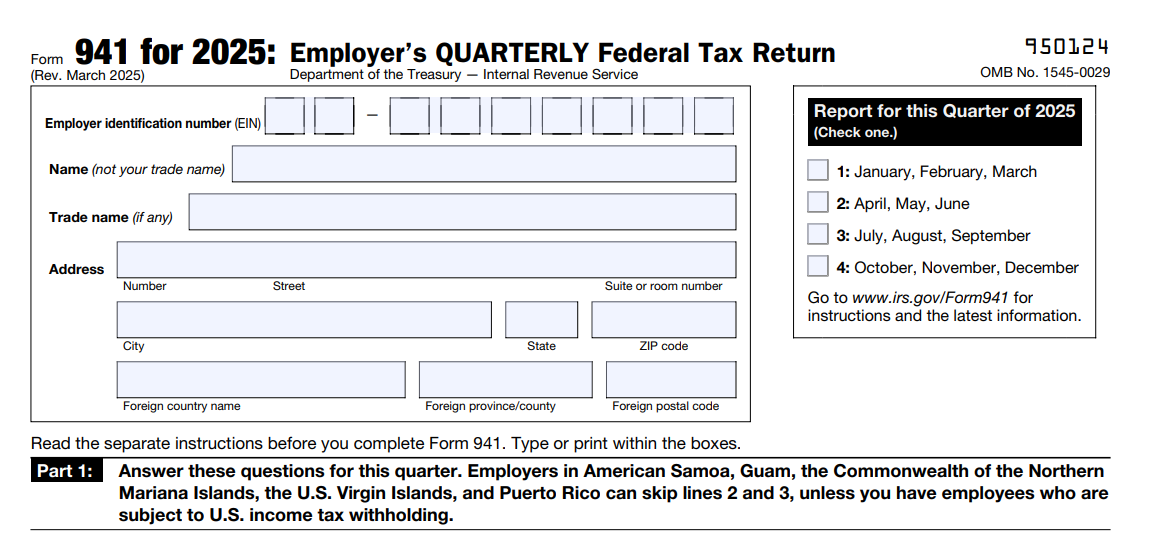

Form 941 Due Dates for 2025

Know the deadlines of the quarterly Form 941

Last Updated:

June 11, 2025

Form 941 is typically due by the last day of the month after the quarter ends. However, you are required to deposit the payroll taxes withheld from your employees before this deadline. Timely filing of your Form 941 and depositing taxes are crucial to avoid penalties from the IRS.

1. When is Form 941 due for 2025?

It is essential to know your Form 941 deadline to stay compliant. The table below contains the Form 941 due dates for the 2025 tax year.

| Quarter | Quarter Ending | Form 941 Due Date |

|---|---|---|

Quarter 1 |

March 31, 2025 |

April 30, 2025 |

Quarter 2 |

June 30, 2025 |

July 31, 2025 |

Quarter 3 |

September 30, 2025 |

October 31, 2025 |

Quarter 4 |

December 31, 2025 |

January 31, 2026 |

Note: If you have deposited the taxes timely and in full, you can file Form 941 before the 10th of the second month of your quarter’s end.

For instance, you have to report the wages you paid during the second quarter on or before July 31. If your tax deposits are on time and in full, you may file Form 941 by the 10th of the second month of the quarter’s end. In this case, you can file Form 941 before August 10 if your deposits are made timely and in full for the second quarter.

2. When are the Form 941 deposit due dates

for 2025?

For taxes reported on Form 941, there are two deposit schedules: monthly and semi-weekly. Before the start of each calendar year, you must determine which deposit schedule applies to your business.

Deposit due date for Monthly Depositor

If you are a monthly depositor, you must deposit employment taxes for payments made during a given month by the 15th day of the following month.

Deposit due date for Semi-Weekly Depositor

- Taxes for payments made on Wednesday, Thursday, or Friday must be deposited by the following Wednesday.

- Taxes for payments made on Saturday, Sunday, Monday, or Tuesday must be deposited by the following Friday.

Next-Day Deposit Rule:

If you accumulate $100,000 or more in taxes on any day during a monthly or semi-weekly deposit period, you must deposit the taxes by the next business day.

3. What happens if you fail to meet the 941 deadlines?

Failing to file IRS Form 941 on time or underreporting your tax liability can lead to penalties from the IRS. These penalties may increase the longer your 941 return remains unfiled or if tax payments are made late or less than the taxes you owe.

For a detailed breakdown of penalty rates and how they are calculated, visit our comprehensive guide: https://expressefile.com/form-941-penalty.

4. How to file Form 941 before due?

You should file Form 941 before the deadline to avoid the penalties mentioned earlier. You can file your Form 941 either by mail or through the IRS-recommended method of e-filing.

For electronic filing,

Electronic filing is the easiest way to file and transmit your IRS Form 941 to the IRS. First, you have to select an IRS-authorized e-file provider and fill out the required information to complete your Form 941. Transmit the form to the IRS on or before the Form 941 due date. By doing so, you will get filing status instantly.

TaxBandits, an IRS-authorized e-file provider and our trusted partner allows you to e-file and transmit your forms to the IRS error-free offering a user-friendly platform to file your 941. You can complete your filing and transmit your return to the IRS in minutes easily.

Click here to get more information on how to e-file form 941.

For paper filing,

If you want to paper file Form 941, send a copy of your form to the correct mailing address with sufficient postage and be postmarked by the U.S. Postal Service. Refer to the above Quarterly Form 941 due date section and send it on or before the deadline. You can refer appropriate 941 mailing address to send your returns.

Visit www.expressefile.com/form-941-mailing-address to get more information about Form 941 mailing address.