Form 941 Instructions: Line-by-Line Explained

Form 941 is filed by employers to report federal income tax withholdings from employees. The calculation of these taxes while filing your return can be quite confusing. You can take a look at these line-by-line Form 941 instructions, to get a better understanding of how to fill out Form 941.

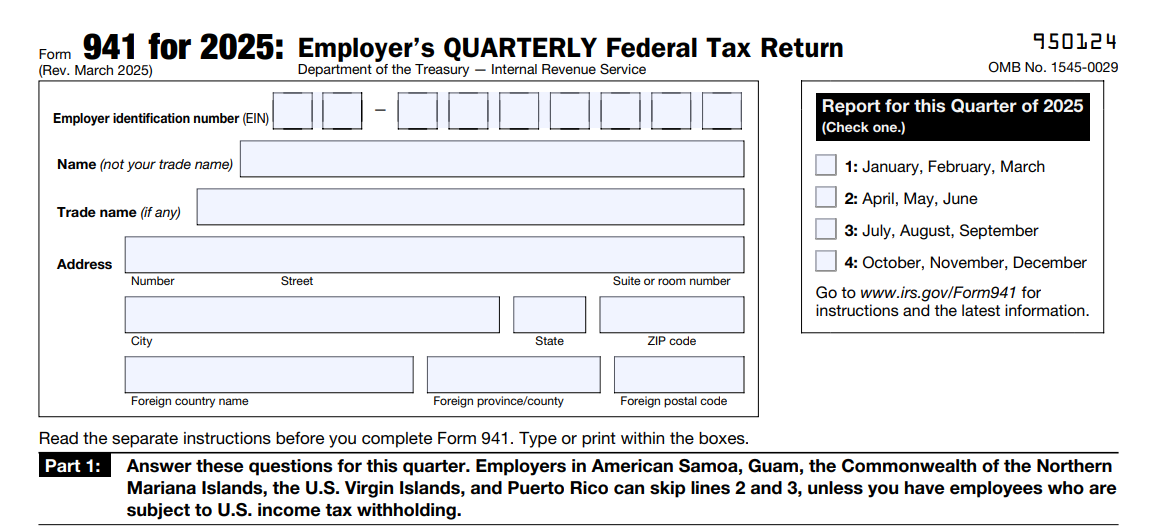

1.Enter Business Information

The first step in filing your Form 941 return is to enter basic information about

your business.

Employer Identification Number (EIN): Enter your business’s 9-digit EIN. It’s mandatory to have an EIN to file Form 941. What if you don’t have an EIN?

Learn more.

Name: Enter the business name associated with the EIN. Please make sure you’re not entering your trade name or DBA name.

Trade name: Enter the other name under which you’re operating your business

(if any)

Business address: Enter your primary business address. The IRS will use this address to send important communication.

Choose the correct quarter for which you are filing your Form 941 return. For example, if you’re filing for the First Quarter, check the box next to

“January, February, March”.

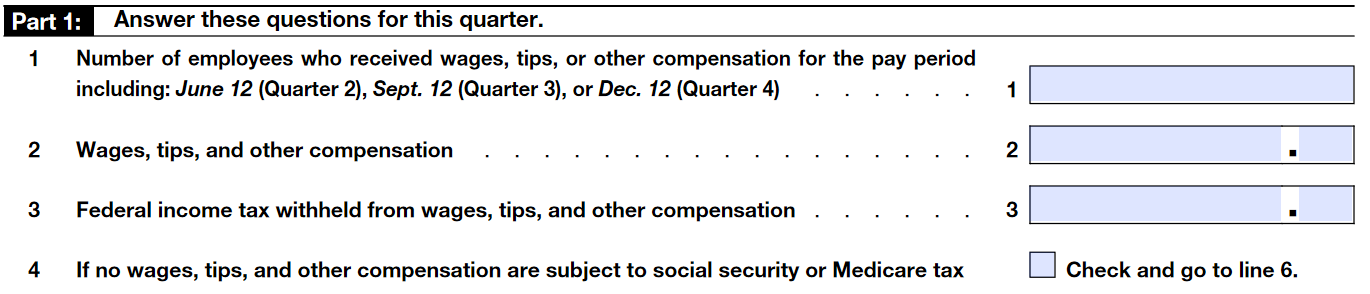

2. Part 1 - Tax withholding details of the Quarter

This part of the return involves reporting information about employees, their wages, and the federal income taxes withheld from their paychecks during

the quarter.

-

Line 1: Number of employees who received wages, tips, or other compensation for the pay period including: March 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4).

Enter the number of employees, who received wages, tips, or other payments in

the quarter. -

Line 2: Wages, tips, and other compensation

Enter the total amount of wages, tips, and other payments paid to all the employees in

the quarter. -

Line 3: Federal income tax withheld from wages, tips, and other compensation

Enter the total amount of federal tax withheld from all the employees’ paychecks.

-

Line 4: Checkbox

If the wages aren’t subjected to any social security or Medicare taxes, check this box. Skip this line if these taxes apply.

-

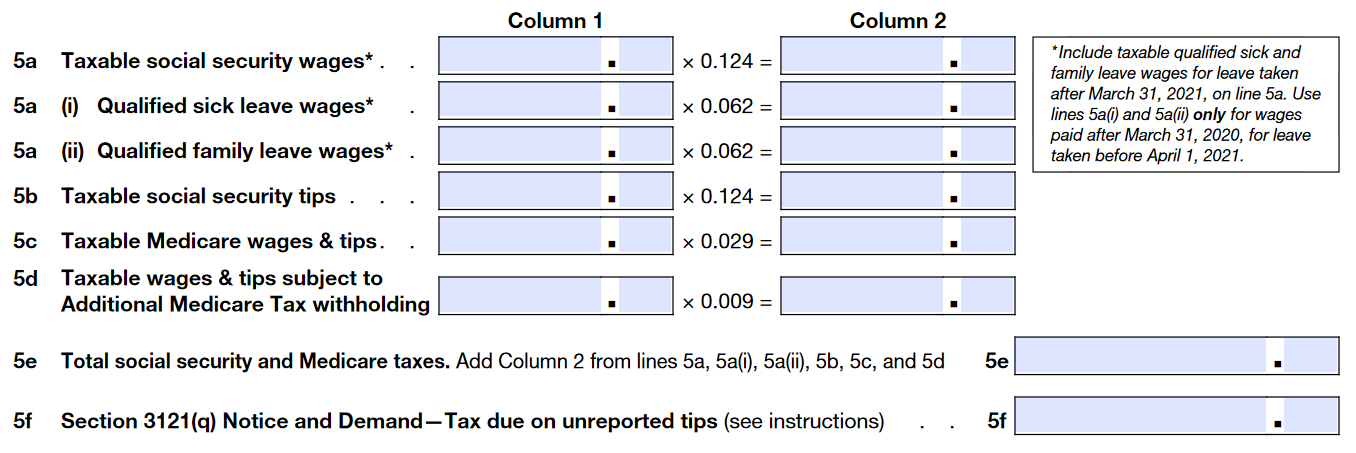

Line 5a: Taxable Social Security Wages

Enter the total amount of taxable security wages received by all employees.

-

Line 5b: Taxable social security tips

Enter the total amount of taxable security tips received by all employees (excluding

pretax amounts). -

Line 5c: Taxable Medicare wages & tips

Enter the total amount of taxable wages, and tips, that are subject to Medicare tax (excluding pretax amounts).

-

Line 5d: Taxable wages & tips subject to Additional Medicare Tax withholding

Enter the total amount of taxable wages & tips subject to Additional Medicare Tax withholding (excluding pretax amounts).

Additional Medicare Tax: If an employee’s wages exceed a certain threshold limit, the employer has to withhold additional Medicare tax from the employee’s pay. The threshold limit is based on the employee’s filing status, and the rate is 0.9%. Below is the threshold limit based on filing status:

Filing Status Threshold Limit Married filing jointly $250,000 Married filing separately $125,000 Single $200,000 Head of household $200,000 Qualifying widow(er) with dependent child $200,000 -

Line 5e: Total social security and Medicare taxes

This line should contain the sum of values from column 2 of lines 5a, 5b, 5c, and 5d.

-

Line 5f: Section 3121(q) Notice and Demand—Tax due on unreported tips

Enter the total tax due received from Section 3121(q) Notice and Demand.

Section 3121(q) Notice and Demand - This is issued by the IRS to advise the employers to report the tips that the employees haven’t reported. The employers aren’t required to report this information until they receive

this notice.

-

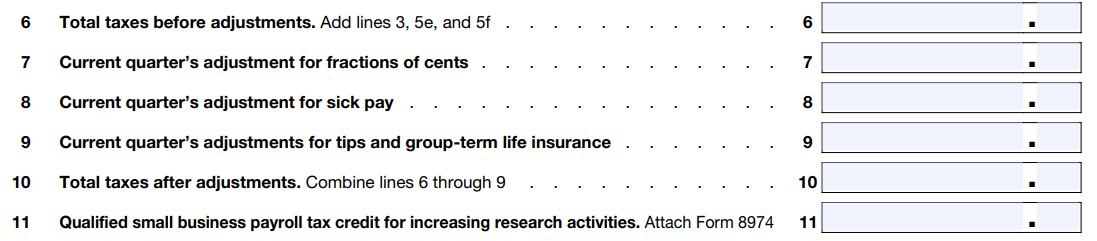

Line 6: Total taxes before adjustments

The value entered in this line should be a sum of lines 3, 5e, and 5f.

-

Line 7: Current quarter’s adjustment for fractions of cents

Enter the adjustment for a fraction of cents.

Fractions-of-cents: While running payroll, social security and Medicare taxes are calculated. If the calculated tax values are in fractions-of-cents, the amount will be rounded to the nearest cent. If you notice a small difference between your total taxes after adjustments and credits and total deposits, you have to report in this line.

-

Line 8: Current quarter’s adjustment

for sick payEnter the adjustment for sick pay.

If your third-party payer of sick pay transfers the liability for the employer share of Social Security and Medicare taxes to you, enter a negative adjustment on line 8 for the amount the third-party payer withheld

and deposited. -

Line 9: Current quarter’s adjustments for tips and group-term

life insuranceEnter the adjustments for tips and group-terms

life insurance.Enter a negative adjustment for any uncollected employee share of social security and Medicare taxes on tips, and the uncollected employee share of social security and Medicare taxes on group-term life insurance premiums paid for former employees.

-

Line 10: Total taxes after adjustments

Enter the total tax after the adjustments. Add the values from lines 6, 7, 8, and 9.

-

Line 11a: Qualified small business payroll tax credit for increasing

research activities. Attach Form 8974.Enter the amount calculated in Form 8974.

Form 8874 - This form is used to calculate the amount of credit that can be claimed for the increasing research activities.

-

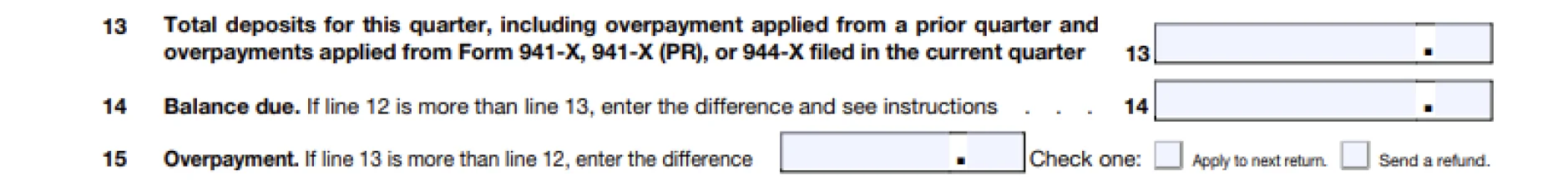

Line 12: Total taxes after adjustments and nonrefundable credits

Enter the total taxes after the adjustments and credits.

-

Line 13: Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter.

Enter the total amount of deposits for the quarter. This should include overpayment applied from previous quarters and Form 941-X for the

current quarter. -

Line 14:

To report your balance due, If line 12 is more than line 13, enter the difference on line 14.

-

Line 15:

This line calculates overpayment. If line 13 is more than line 12, enter the difference on Line 15.

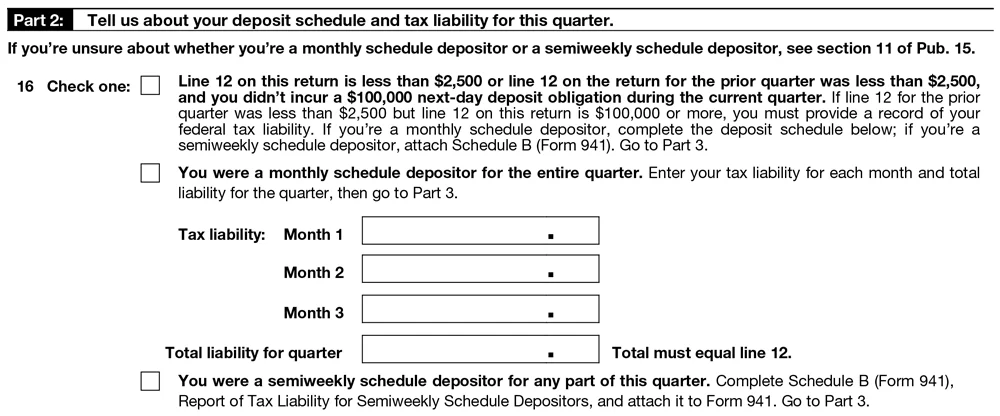

3. Part 2 - Deposit schedule and tax liability for the quarter

This part requires you to enter information about the tax liability and the time

of deposit.

-

Line 16: CheckBox

Check the appropriate box based on your tax liability. Check the boxes if it passes the following conditions.

CheckBox 1

- If the value on line 12 is less than $2500.

- If the value on line 12 was less than $2500 for the previous quarter.

- If you didn’t incur a next-day deposit obligation of $100,000 for the current quarter.

CheckBox 2

If you’re a monthly schedule depositor for the quarter. You need to enter the value of tax liability for each month during the quarter. Your total liability for the quarter should be the same as the value on line 12.

CheckBox 3

If you’re a semiweekly schedule depositor for the quarter. Enter the tax liability on Schedule B and attach it along with your Form 941.

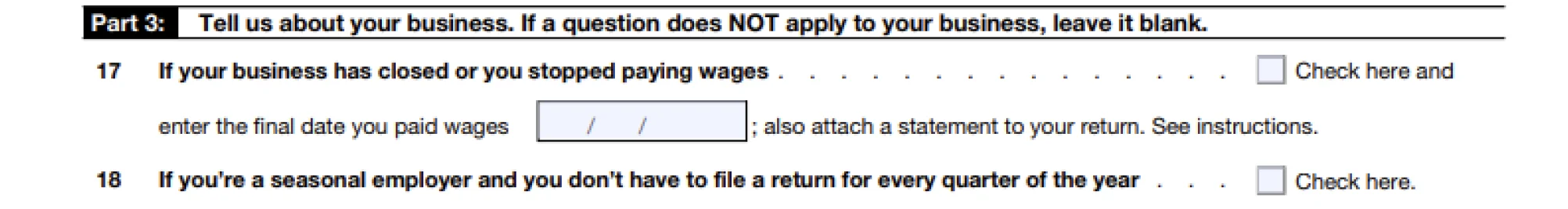

4. Part 3 - About your business

This section is used to provide information about your business.

-

Line 17: CheckBox

Check this box if your business was closed or didn’t pay any wages for the whole quarter. If you check this box, enter the date on which the wages were

finally paid. -

Line 18:

Check this box if you’re a seasonal employer, and you aren’t required to file Form 941 for every quarter.

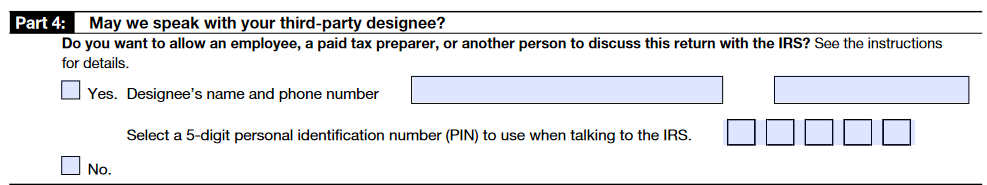

5. Part 4 - Third Party Designee - CheckBox

Check this box if you decide to discuss your Form 941 return with the IRS.

If you choose yes - Enter the designee’s name and phone number. Provide any 5 digit PIN, which should be used while talking to the IRS.

If you choose no - Skip this section.

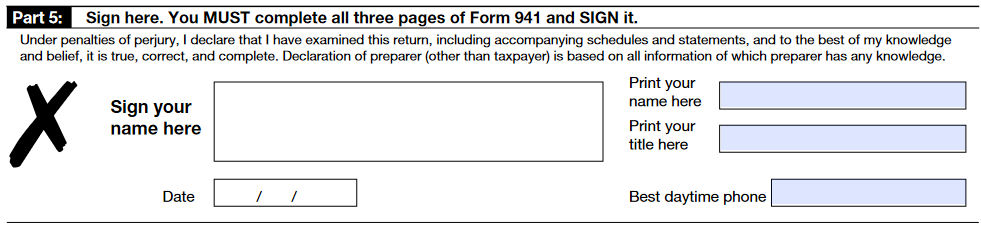

6. Part 5 - Signature

After the completion of all the parts in Form 941, you are required to sign the form before transmitting it to the IRS. Here are the signing authorities for each type of companies:

- Sole proprietorship: Individual who owns the company

- Corporation or an LLC treated as a corporation: President, vice president, or other

principal officer - Partnership or an LLC treated as a partnership: Partner, member,

or officer - Single-member LLC: Owner of the LLC or a principal officer

- Trust or estate: The fiduciary

- Enter the total amount of deposits for the quarter. This should include overpayment applied from previous quarters and Form 941-X for the current quarter.

- If you’re a semiweekly schedule depositor for the quarter. Enter the tax liability on Form 941 Schedule B and attach it along with your Form 941.

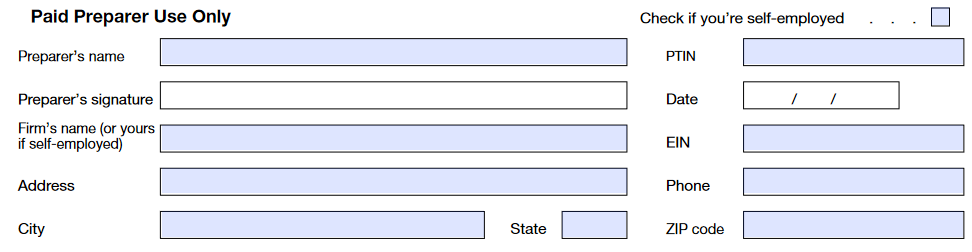

- Paid Preparers - Tax preparers must have filed a valid power of attorney form, to file Form 941 on behalf of a client. The paid preparer must provide his name, address, phone number, signature, and PTIN.

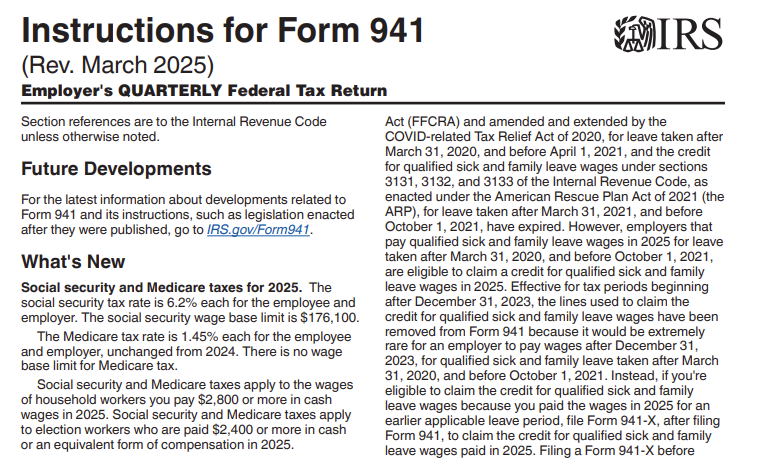

The IRS has revised Form 941 for 2025. Accordingly, Form 941 has undergone major changes which include an increase in the Social Security wage base limit, removal of the ability to claim COVID-19-related credits on Form 941, and introduction of e-filing of Form 941-X. Visit https://blog.taxbandits.com/the-irs-released-form-941-for-2025-key-changes-and-updates-released-by-the-irs/ to know about the changes in Form 941 for 2025.

How to fill out Form 941 Online?

Employers can e-file Form 941 easily with ExpressEfile by following a few simple steps. Just enter the required information, review the form, and transmit it directly to the IRS. The whole process takes only a few minutes.

ExpressEfile offers the lowest price of $5.95 for

filing Form 941.