E-File Form W-2c for 2024

- Correct Form W-2 in Minutes

- Postal Mail Corrected Copies

- Download & Print Form Copies

- Form W-3c will be generated for your reference

Pricing starts as low as $2.75/form

Benefits of filing W-2c Form Online with ExpressEfile

Correct W-2 in Minutes

File Form W-2c in a few minutes with the help of our easy flow and

step-by-step instructions throughout

the filing.

Postal Mail

Corrected Copies

Let us postal mail the corrected copies to your employees on your behalf while filing the

correction form.

Download & Print Form Copies

Download and print the

W-2 corrected copies from the print center at any time. All saved securely in

the cloud.

Get W-3c for free

Get your Form W-3 based on the correction and access it from your account. Keep the form for

your records.

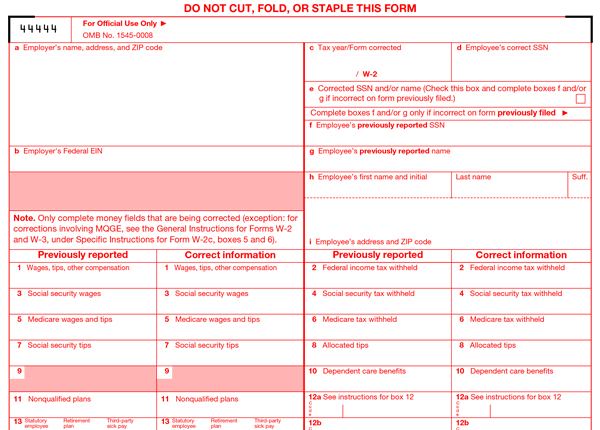

What information can be corrected in Form W-2c?

You can correct almost all the information reported in the originally filed W-2 form. With ExpressEfile, you can easily file Form W-2c to correct the following information:

- Incorrect tax year

- Incorrect employee name or Social Security Number (SSN)

-

Incorrect employee earnings or tax withholdings:

- Wages, Tips and Other Compensation

- Social Security Wages, tips, and tax withheld

- Federal Income Tax Withheld

- Allocated Tips and Dependent Care Benefits

If you are not required to file a W-2 return but filed it, you will have to void the filed return.

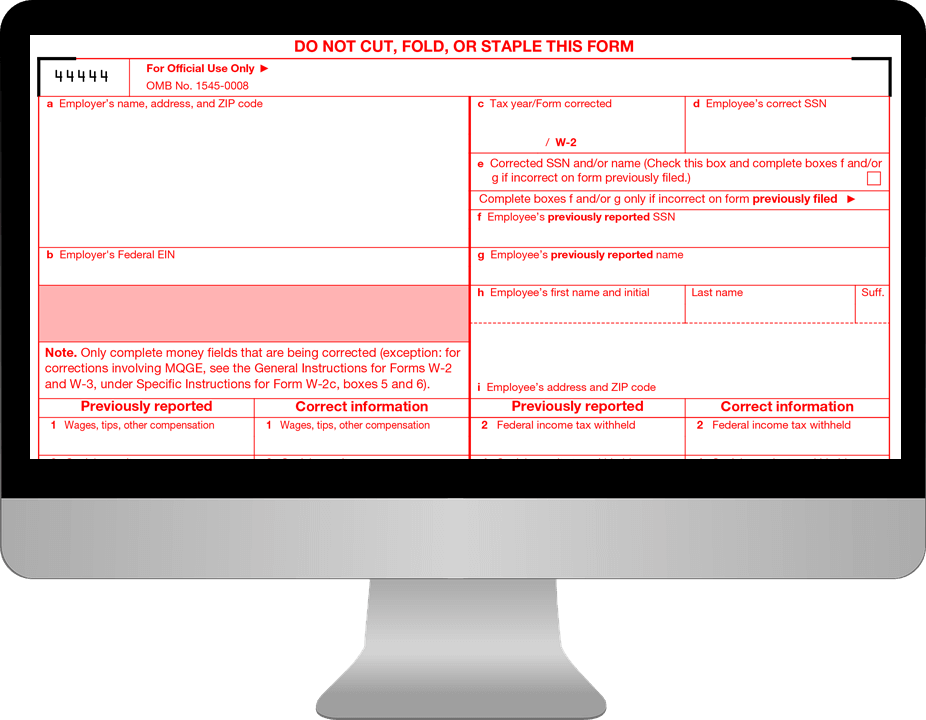

How to File Form W-2c Online?

Filing W-2 correction forms with ExpressEfile takes only a few minutes. Follow the steps below to file corrections for W-2 forms.

Choose the

correction type

Select the type of correction that you want to make in the return, i.e., voiding the filed return or correcting the reported information.

Enter the correct information

Enter the information that needs to be corrected along with the previously reported information in the respective fields of the return. You will see the originally reported info.

Review & Transmit

to SSA

Preview the draft form to make sure the information entered is correct. Then, transmit the return to

the SSA.

Frequently Asked Questions on Form W-2c

When is the deadline for filing W-2 corrections?

There is no specific deadline to file Form W-2c; however, you will need to file corrections as soon as you find the mistakes in your returns. Also, you will need to send the corrected copies to your employees.

Is there any penalty for filing W-2 forms with incorrect information?

The SSA may impose a penalty of $250/return for failure to include all of the information required to be shown on the return or the inclusion of incorrect information. The w2 penalty will increase up to $3,000,000 for a calendar year.

How do I correct the tax year, name, or SSN reported in Form W-2?

Enter both the originally reported and correct tax year, name, and SSN in Form W-2c, preview the form, and then transmit it to the IRS.

How to file corrected Form W-3c?

If you are e-filing Form W-2c through ExpressEfile, you are not required to file Form W-3c with the SSA. However, if you are filing Form W-2c by paper, you must file

Form W-3c.

Ready to E-File Form W-2c with ExpressEfile?

E-File the corrected W-2 in minutes and postal mail recipient copies.

Pricing starts as low as $2.75/form