Revised Form 941 Worksheet 1 for Q3 2023

Credit for Qualified Sick and Family

Leave Wages and the

Employee

Retention Credit

E-file Form 941 for the lowest price ($5.95)

with ExpressEfile. E-file Now

IRS Form 941 Worksheet 1 - Explained

Updated on October 23, 2023 - 10:30 AM by Admin, ExpressEfile

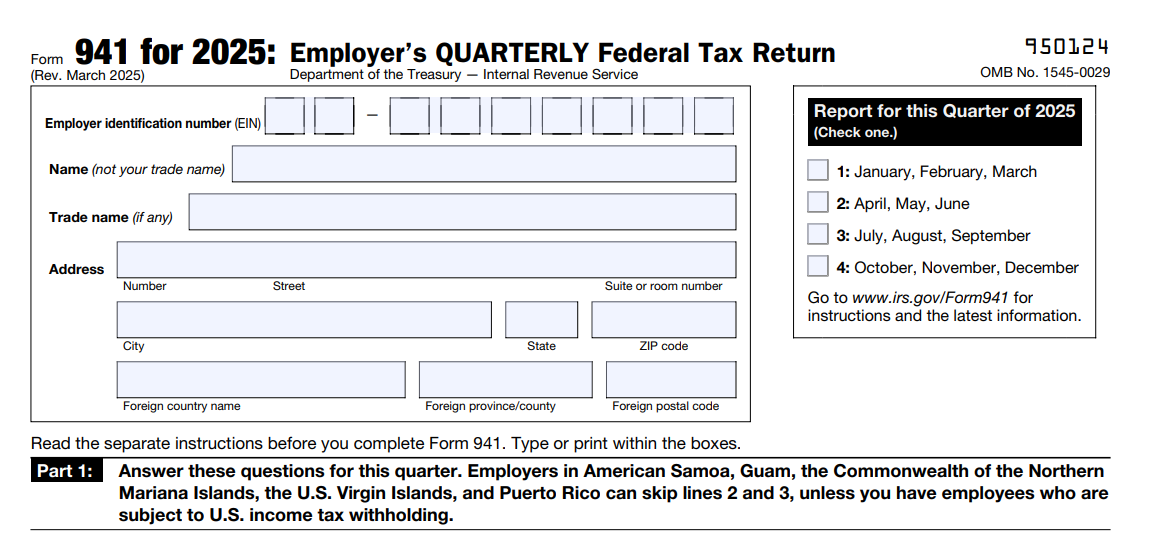

Form 941, Employer's QUARTERLY Federal Tax Return, filed by employers in the United States has seen multiple revisions this year due to the COVID-19 pandemic. The IRS initially revised Form 941 for quarter 2, 2020, to accommodate the relief measures announced by the government to overcome the pandemic. So, from quarter 2, 2020, employers must

file the revised Form 941.

To calculate the tax credits applicable for the reporting period accurately, the IRS has introduced Worksheet 1 (available on Page 20 of Form 941 instructions). If you’re an employer who are likely to apply for the COVID-19 tax credits, you must know about Form 941 Worksheet 1 and how to use it.

This article covers the following topics:

1. Why IRS Form 941 Worksheet 1?

The main purpose of this worksheet is to help employers calculate their tax credits accurately and then claim it on their tax return, i.e., Form 941. The credits include:

- Nonrefundable and refundable portion of credit for qualified sick and family leave wages

- Nonrefundable and refundable portion of employee retention credit

These credits can be calculated in 3 steps by entering the required information.

You can easily complete Worksheet 1 without worrying about errors if you choose to

e-file Form 941 using ExpressEfile.

E-file Form 941 Now

2. Who should use 941 Worksheet 1?

Employers who claim refundable tax credits due to COVID-19 must use this worksheet.

3. How to complete Form 941 Worksheet 1?

Before proceeding to complete Worksheet 1, make sure you have all the required information. As mentioned, this worksheet contains 3 steps. Let’s see what should be done in each step.

-

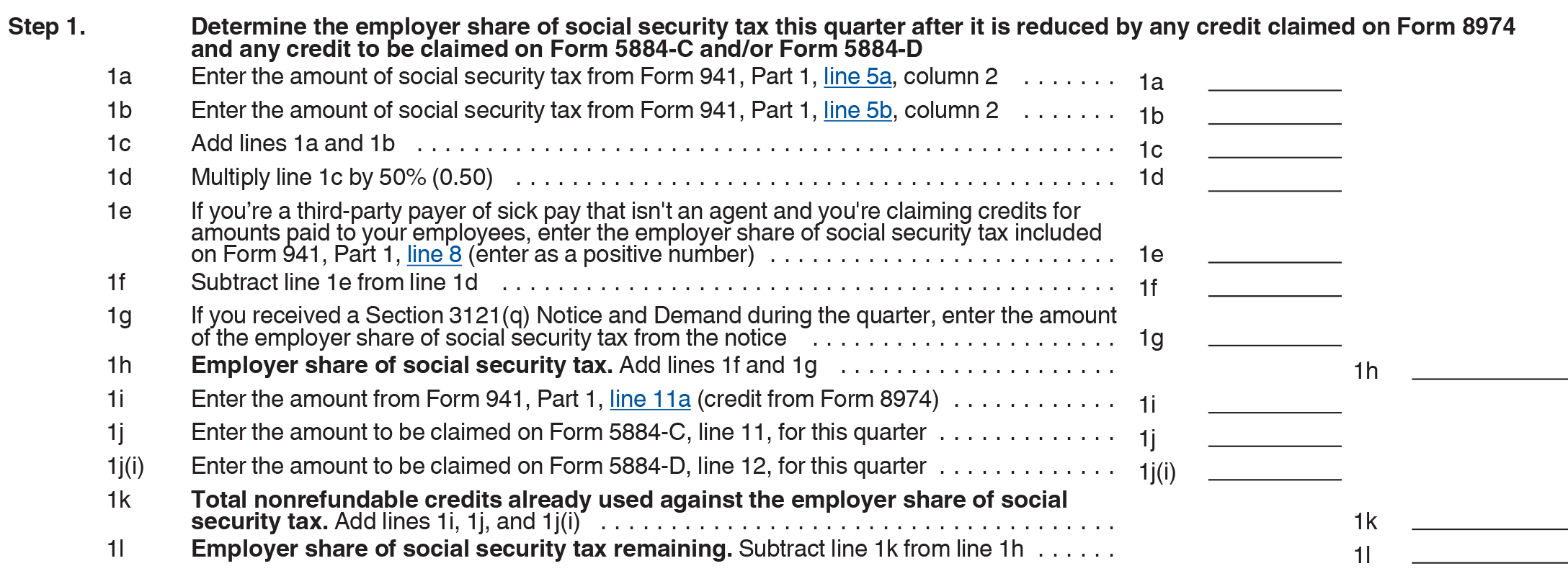

Step 1: Determine the employer share of social security tax this quarter after it is reduced by any credit claimed on Form 8974 and any credit to be claimed on Form 5884-C and/or Form 5884-D

By completing this step, you can determine the remaining employer share of social security tax excluding the credits claimed on Form 8974 and credits to be claimed on Form 5884-C and/or 5884-D.

-

To do so, add Form 941, Part 1, line 5a, column 2, and Form 941, Part 1, line 5b, column 2. Then, multiply the total by 50% (0.50).

Subtract the amount with any adjustments on line 8 of Form 941, if you're a third-party sick payer, and then add the result to the amount employer share of social security tax from the Section 3121(q) Notice and Demand, if any, during the quarter. You will get the employer share of social security tax (1h).

Add the amount from Form 941, line 11a (credit from Form 8974), and the amounts to be claimed on Form 5884-C, lines 11 and 12, for the applicable quarter to get the total nonrefundable credits already used against the employer share of social security tax (1k).

Now, subtract line 1k from 1h to get the employer share of social security tax remaining.

-

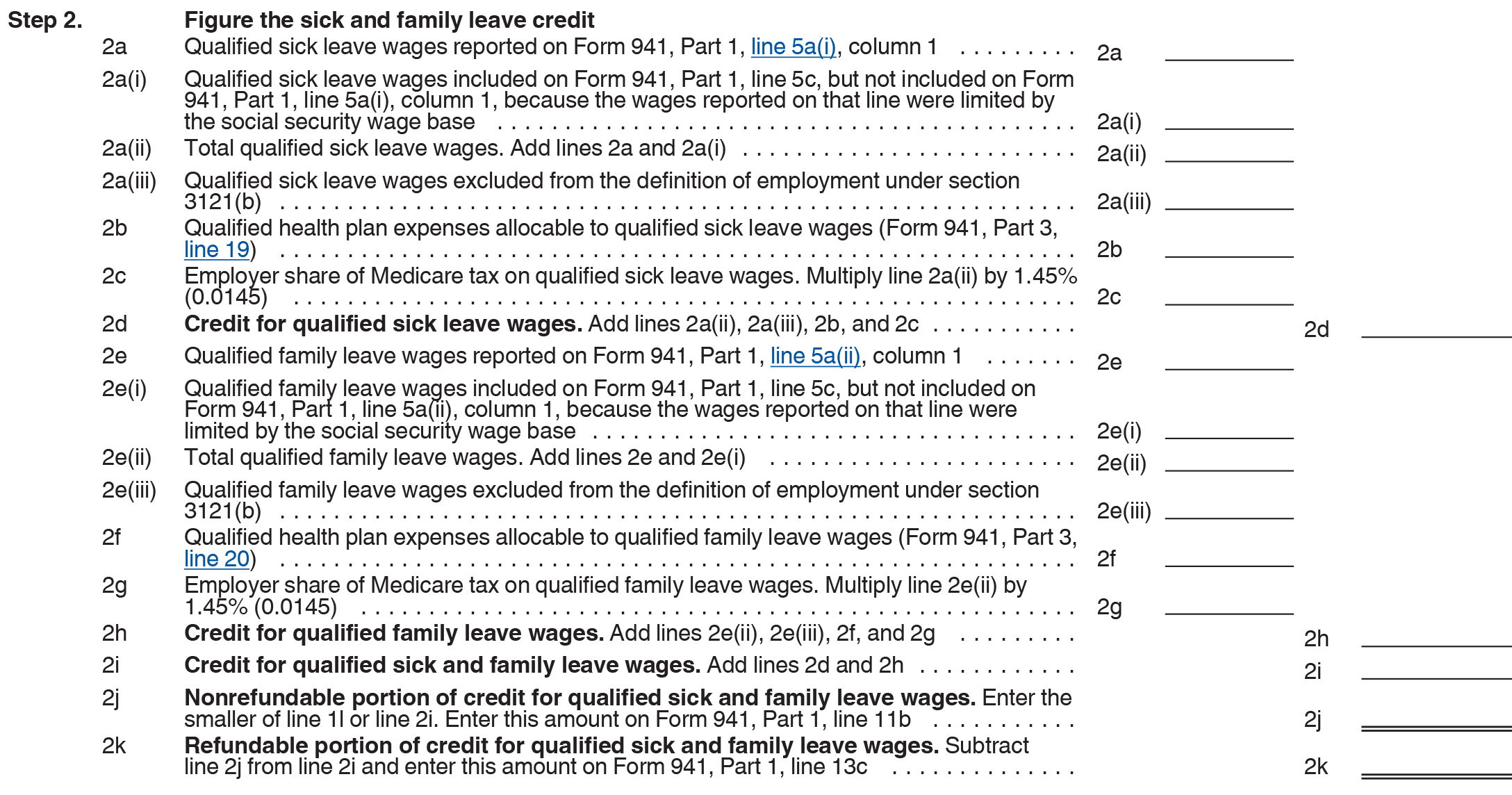

Step 2: Figure the sick and family leave credit.

By completing this step, you can determine the nonrefundable and refundable portion of credit for qualified sick and family leave wages.

-

Calculating the credit for qualified sick leave wages

- First, determine the total qualified sick leave wages (line 2a(ii) in Worksheet 1) by adding the qualified sick leave wages reported on Form 941, Part 1, line 5a(i) column 1 and line 5c (but not included on Form 941, Part 1, line 5a(i)).

- Then, determine the employer share of Medicare tax on qualified sick leave wages (line 2c in Worksheet 1) by multiplying the total qualified sick leave wages by 1.45% (0.0145).

- Now, calculate the credit for qualified sick leave wages (line 2d in Worksheet 1) by adding total qualified sick leave wages (line 2a(ii)), qualified sick leave wages excluded from the definition of employment under section 3121(b), qualified health plan expenses allocable to qualified sick leave wages (Form 941, Part 3, line 19), and employer share of Medicare tax on qualified sick leave wages (line 2c).

Calculating the credit for qualified family leave wages

- First, determine the total qualified family leave wages (line 2e(ii) in Worksheet 1) by adding the qualified family leave wages reported on Form 941, Part 1, line 5a(ii) column 1 and line 5c (but not included on Form 941, Part 1, line 5a(ii)).

- Then, determine the employer share of Medicare tax on qualified family leave wages (line 2g in Worksheet 1) by multiplying the total qualified family leave wages by 1.45% (0.0145).

- Then, calculate the credit for qualified family leave wages (line 2h) by adding total qualified family leave wages (line 2e(ii)), qualified family leave wages excluded from the definition of employment under section 3121(b), qualified health plan expenses allocable to qualified family leave wages (Form 941, Part 3, line 20), and employer share of Medicare tax on qualified family leave wages (line 2g).

Now, calculate the credit for qualified sick and family leave wages (line 2i) by adding the credit for qualified sick leave wages (line 2d) and credit for qualified family leave wages (line 2h)

Report these credits on Form 941:

- Enter line 1l or 2i, whichever is smaller, on Form 941, Part 1, line 11b, as the nonrefundable portion of credit for qualified sick and family leave wages.

- Subtract line 2j from 2i and enter this amount on Form 941, Part 1, line 13c, as the refundable portion of credit for qualified sick and family leave wages.

Looks complex? Simply e-file Form 941 using ExpressEfile and complete the worksheet in just a few clicks. All your worksheet information will be auto-populated from your information. E-file Form 941 by completing Worksheet 1

-

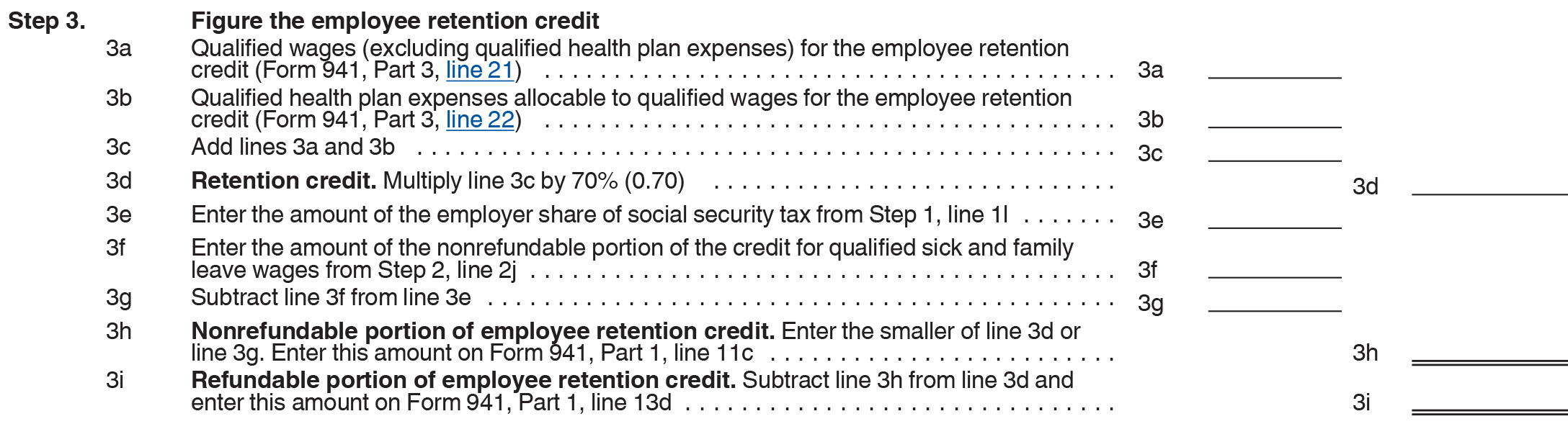

Step 3: Figure the employee retention credit

By completing this step, you can determine the nonrefundable and refundable portion of employee retention credit.

-

- First, calculate the retention credit for the quarter by adding qualified wages (excluding qualified health plan expenses) for the employee retention credit (Form 941, Part 3, line 21) and qualified health plan expenses allocable to qualified wages for the employee retention credit (Form 941, Part 3, line 22), then multiplying the total by 70% (0.70).

- Now, subtract the amount of the nonrefundable portion of the credit for qualified sick and family leave wages from Step 2, line 2j from amount of the employer share of social security tax from Step 1, line 11 and enter the difference on Step 3, line 3g.

Report these credits on Form 941:

- Enter line 3d or 3g, whichever is smaller, on Form 941, Part 1, line 11c, as the nonrefundable portion of employee retention credit.

- Subtract nonrefundable portion of employee retention credit from retention credit and enter the difference on Form 941, Part 1, line 13d, as the refundable portion of employee retention credit.

Did you know? The IRS rejects many paper-filed 941 forms due to the errors in returns. Note that the IRS will reject a return with incorrect tax credits. Switch to e-filing and reduce the chances of rejection. ExpressEfile has an in-built audit check that analyzes your return against the IRS business rules.

E-file Form 941 NowIf you have all the required information, you can complete this worksheet in no time. However, you may not be required to complete all steps in the worksheet. It’s completely based on how you’ve paid your employees in the reporting quarter. See below to learn what are all the steps you need to complete based on your business’s payroll:

In the reporting quarter, you have paid your employees:

- both sick and family leave wages and qualified wages under employee retention credit: You have to complete Steps 1, 2, and 3 of Worksheet 1.

- only sick and family leave wages (no qualified wages under employee retention credit): You have to complete Steps 1 and 2 of Worksheet 1.

- only qualified wages under employee retention credit (no sick and family leave wages): You have to complete Steps 1 and 3 of Worksheet 1.

4. File Form 941 by completing Worksheet 1 through ExpressEfile

As recommended by the IRS, it’s always better to e-file Form 941 for quick processing of returns. With ExpressEfile, you can e-file Form 941 in less than 5 minutes for $5.95/form only.

The in-built audit check checks your return based on the IRS business rules and decreases the chances of a form rejection.

Here’s how to file Form 941 by completing Worksheet 1 through ExpressEfile:

- Sign in to ExpressEfile and choose Form 941.

- Select the quarter you’re filing the return.

- Enter the Part 1 information and then complete Worksheet 1 in line 11b by clicking the worksheet icon. ExpressEfile will map required information from your Form 941 and calculate credits for you.

-

Enter Part 2 and 3 information. Complete Schedule B (if you’re a semiweekly depositor) and

Form 8974 (if you have applied small business tax credit for increasing research activities). - Review your form and edit if necessary.

- Select the payment method for paying tax dues.

- E-sign your return by entering your Online Signature PIN or completing the

Form 8453-EMP (authorizing ExpressEfile to transmit returns on your behalf). - Transmit the return directly to the IRS.

Once your Form 941 has been processed by the IRS, you’ll receive an email with the status of

your return.

File your Form 941 by completing the Worksheet 1 through ExpressEfile now for the lowest price in the industry, Only $5.95/return.

Checkout this video to know how to complete the 941 Worksheet 1.

File with confidence. It’ll take only a few minutes.