Changes in Form 941 for 3rd & 4th

Quarter, 2020

Updated on October 09 - 10:30 AM by Admin, ExpressEfile

On September 30, 2020, the IRS finalized the Form 941 for

quarter 3, and employers must file the revised form 941 for the quarter 3.

Form 941 was revised for quarter 2, 2020, to accommodate the reporting of refundable employment tax credits, advance payment of employment tax credits, and deferral of employment taxes.

Let's see about the changes in Form 941 for Quarter 3 & 4. The following are the topics covered in this article.

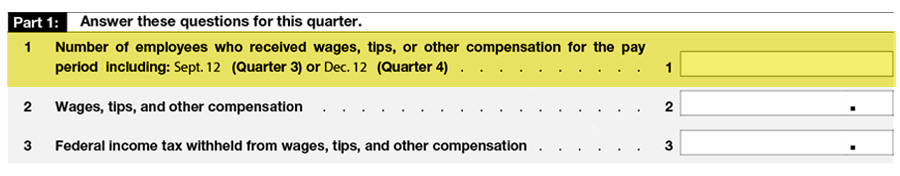

1. Form 941 - Things to Report

Form 941, Employer’s Quarterly Federal Tax Return, is filed by employers every quarter to report the following to

the IRS:

- Wages paid during the quarter

- Tips reported by employees

- Federal income tax withheld from employees

- Employee and employer share of FICA taxes (social security and Medicare)

- Additional Medicare taxes withheld from employees

- Adjustments to social security and Medicare taxes for fractions of cents, sick pay, tips, and group-term life insurance for the quarter

- Employer share of deferred social security tax

- Qualified small business payroll tax credit for increasing research activities

- Credit for qualified sick and family leave wages.

- Employee retention credit

The IRS has revised Form 941 for Q2, 2021. The American Rescue Plan Act of 2021 (ARP), signed into law on March 11, 2021, includes relief for employers and their employees during COVID-19. As always employers need to report

COVID-19 credits on Form 941, so the IRS has updated the form to reflect the ARP.

File Form 941 With ExpressEfile easily and quickly at lowest price ($3.99) in

the industry.

2. Changes in Payroll Tax Deferment

The Presidential Memorandum on Deferring Payroll Tax Obligations has been issued on August 08, 2020, to tackle the COVID-19 disaster. This memorandum was released directing the Department of Treasury to issue guidance allowing employers to defer the employee portion of social

security taxes.

On August 28, 2020, the IRS published guidance under Notice 2020-65. The Notice states that employers can defer the 6.2% withholding of employee social security taxes for the wages paid between September 1 and December 31, 2020. It’s not mandatory to defer the employee portion of social security taxes. Employers who elect to defer must pay the tax by April 30, 2021.

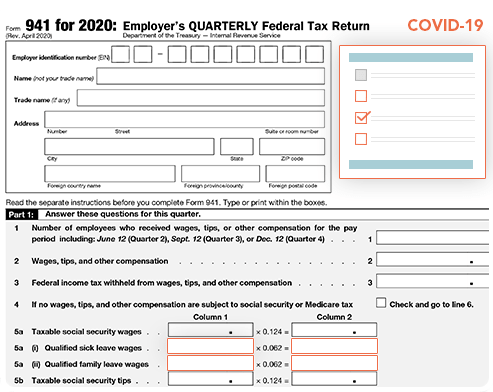

3. Form 941 for Quarter 3 & 4 - What are the changes?

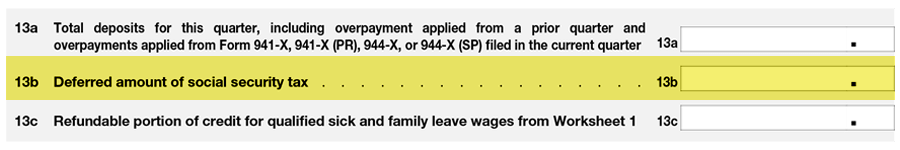

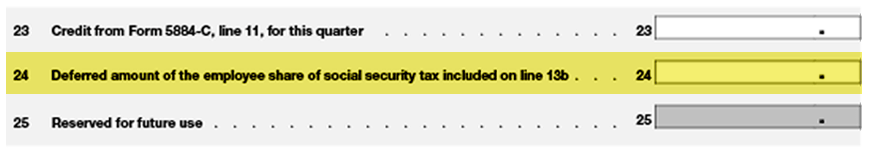

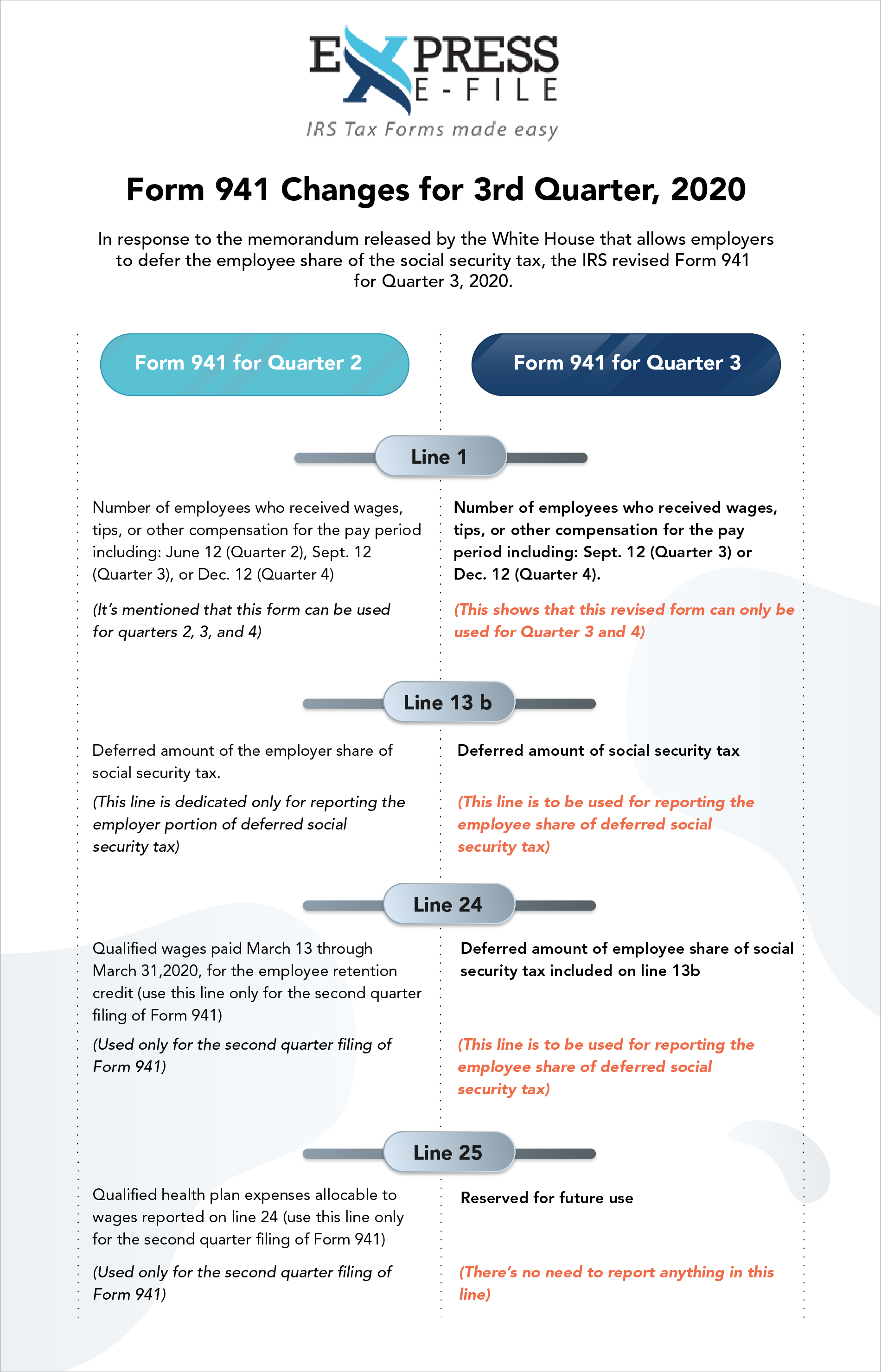

Since the employers can elect to defer the employee portion of social security taxes for the wages paid between Sep. 1 and Dec. 31, 2020, the IRS has released a draft version of Form 941 for Quarter 3, accommodating the changes. There will be changes in four lines, i.e., Lines 1, 13b, 24, and 25. On September 30, 2020, the IRS finalized Form 941 for Q3, and employers must file the revised form 941 for the quarter 3.

Here are the changes in Form 941 for Quarter 3 :

-

Line 1

This shows that this revised form can only be used for Quarter 3

-

Line 13 b

This line is to be used for reporting both the employer and employee share of deferred social security tax.

-

Line 24

This line is to be used for reporting the employee share of deferred social security tax.

-

Line 25

This line is only reserved for future use. There’s no need to report anything in this line.

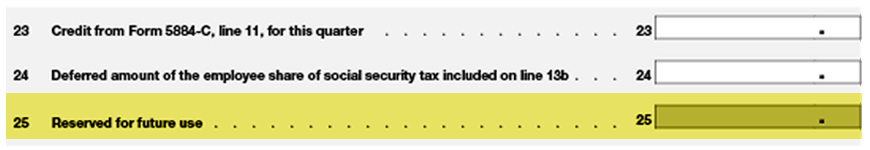

Difference between Form 941 for quarter 2 and quarter 3, 2020

Below is a comparison of the earlier and new Form 941 to give a clear understanding for you to file Form 941 for the 3rd quarter:

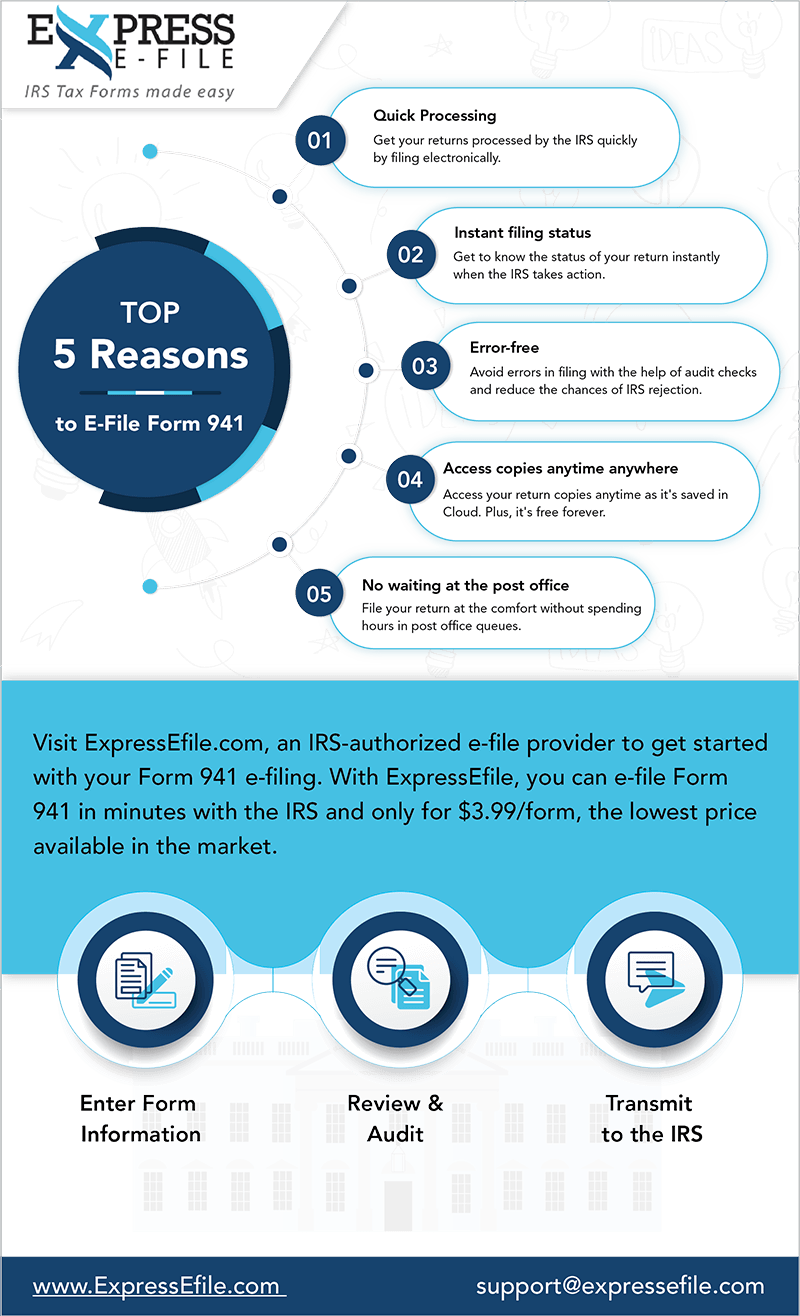

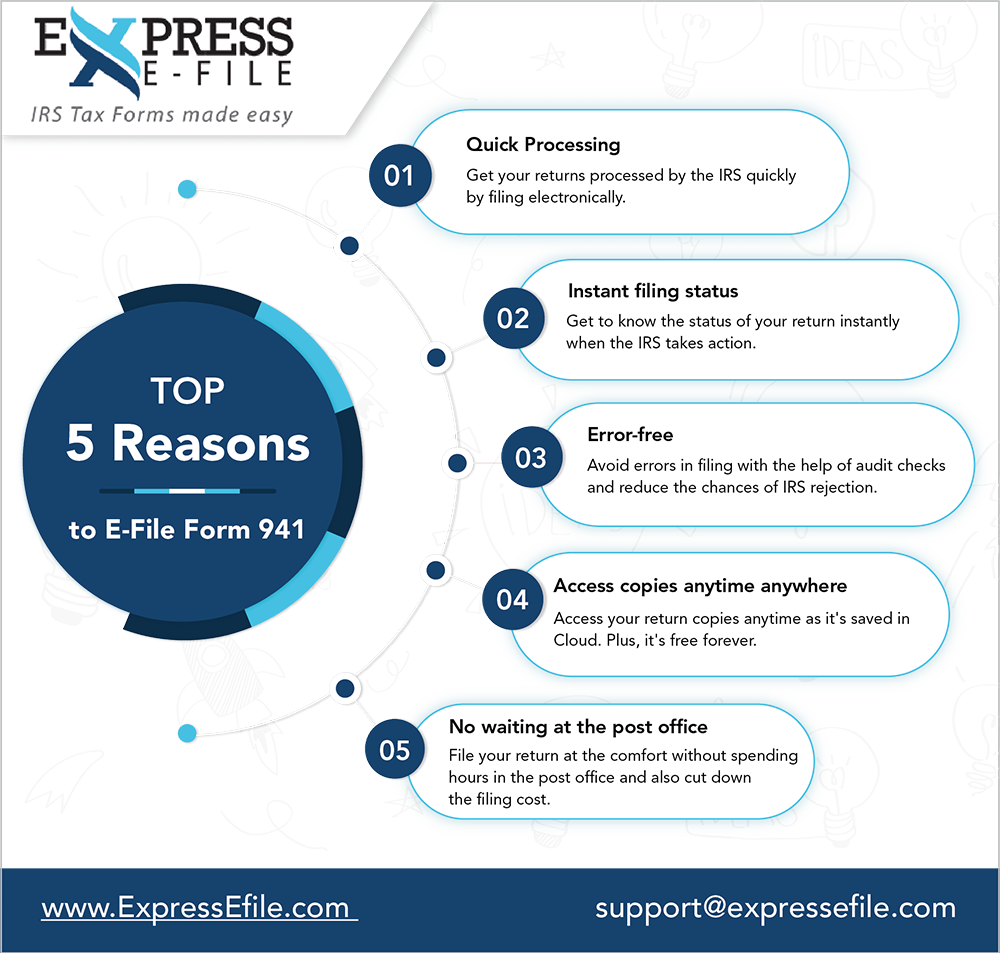

4. Top 5 Reasons to E-file Form 941

There are many reasons to prefer e-filing of Form 941 over paper filing, including quick processing of returns. Here are the top 5 reasons why should you e-file

Form 941 :

5. File Form 941 for Quarter 3 & 4, 2020

Though you can file Form 941 using multiple options, the IRS recommends that you

e-file Form 941 for quick processing. Employers can e-file Form 941 with quarter 3 changes easily with ExpressEfile by following a few simple steps.

- 1. Just enter the required information

- 2. Review the form, and

- 3. Transmit it directly to the IRS.