E-File Your 1099 Forms Securely

- Quick Processing

- In-built Error Check

- Instant Filing Status

- Postal Mail Recipient Copies

Pricing starts as low as $1.49/form

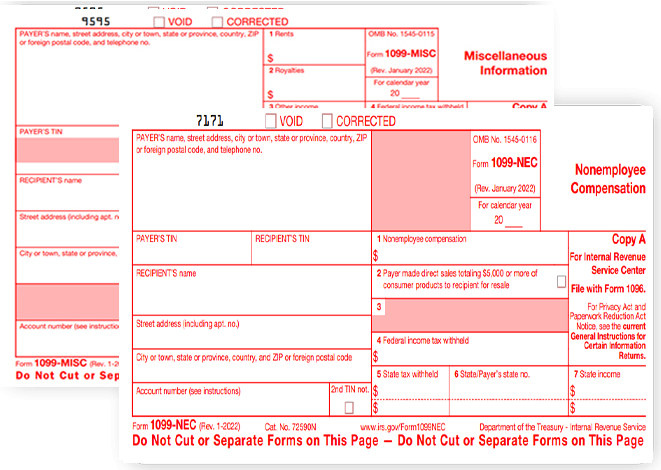

Which Form 1099 Should You File?

If you have made a payment of $600 or more to an independent contractor as compensation or if you have withheld any taxes, you must file Form 1099-NEC.

E-File 1099-NEC NowPayers who made miscellaneous payments of $600 or

more to payees in a calendar year

must

file Form 1099-MISC.

Benefits of Filing Form 1099 Online With ExpressEfile

Below are the best benefits you’ll get when you E-file Form 1099s through ExpressEfile.

Instant Filing Status

Receive filing status instantly as soon as the IRS processes your returns.

In-built Error Check

Get your returns validated based on the IRS business rules and

avoid rejection.

Postal Mailing

Let us postal mail the return copies to your recipients on

your behalf.

Download Copies

Download form copies at any time from your account at no

additional charge.

Start filing your 1099 forms and get an instant approval from the IRS

How to File Form 1099 Online?

With ExpressEfile, you can complete the filing of Form 1099 in minutes.

Enter Information

Enter the form information such as payer and payee details, and

payments made.

Review Form

Review the 1099 form and

make sure the information

entered is correct.

Transmit to IRS

If everything looks good,

you can simply transmit the

return to the IRS.

Start E-filing Form 1099s. It takes less than 5 minutes.

Customer Testimonials

Make the smart choice of e-filing

with ExpressEfile

Frequently Asked Questions on Form 1099

Do I have to file both Form 1099-NEC and 1099-MISC?

It depends on the payments you have made to the independent contractor. If you have paid a contractor at least $600 as compensation, you will have to file Form 1099-NEC. If you have made miscellaneous payments of $600 or more to the contractor, you will have to

file Form 1099-MISC for them. In case you have paid a contractor both nonemployee compensation and miscellaneous payments, you have to file both Form 1099-NEC and 1099-MISC.

With ExpressEfile, you can file both 1099-NEC and 1099-MISC easily and securely. E-File Now

How long does it take for the IRS to accept the Form 1099 return?

The IRS may take up to 2 business days to process Form 1099s; however, the processing time may differ based on the return volume processed by the IRS. If you e-file Form 1099 with ExpressEfile, you will receive the filing status instantly as soon as the IRS processes

your return.

When is the deadline to file 1099 forms?

Form 1099-NEC must be filed and recipient copies should be furnished on or before January 31st every year. For Form 1099-MISC, recipient copies should be furnished on January 31st and if you are filing Form 1099-MISC electronically, the deadline is March 31st and for paper filing, the deadline is February 28th.

Note: If the deadlines fall on a weekend or federal holiday, the form can be filed the next business day.

Does ExpressEfile send recipient copies on my behalf?

Yes, if you opt for the postal mailing add-on while filing the return, the copies will be postal mailed to the recipients on your behalf.

How much does it cost to file Form 1099?

With ExpressEfile, you can file Form 1099 with the IRS for as low as $1.49 per return. If you want us to mail the return copies to your recipients on your behalf, you may opt for the postal mailing add-on for $1.50 per return.

Ready to E-file Form 1099 for the 2020 Tax Year?

E-File your 1099-NEC and 1099-MISC in minutes and postal mail

recipient copies.

Pricing Starts as low as $1.49/form