File Form 7200 Online

Advance Payment of Employer Credits Due to COVID-19

File 7200 NowComplete and Submit Form 7200 in less than 2 minutes

Simplify Form 7200 Online Filing with ExpressEfile

Lowest Price

File Form 7200 to the IRS only for $1.49/form. Even low compared to your paper filing cost.

Built-in Error Check

Our internal audit check makes sure your return is error-free to transmit with the IRS, reducing the chances of the form rejection.

Fax Form 7200

Once you complete the form information, we will FAX Form 7200 to the IRS on your behalf reducing your burden in this pandemic situation.

Instant Filing Status

Once the IRS processes your return, we will notify you about the filing status from the IRS.

Why should you choose ExpressEfile to File Form 7200?

Fax Form 7200 to the IRS

Easy to use Dashboard

Review Form Summary

Lowest Price in the industry

Accurate Calculations

Make Corrections before filings

Instant IRS Filing Status

Built-in Error Check

Download & Print Forms

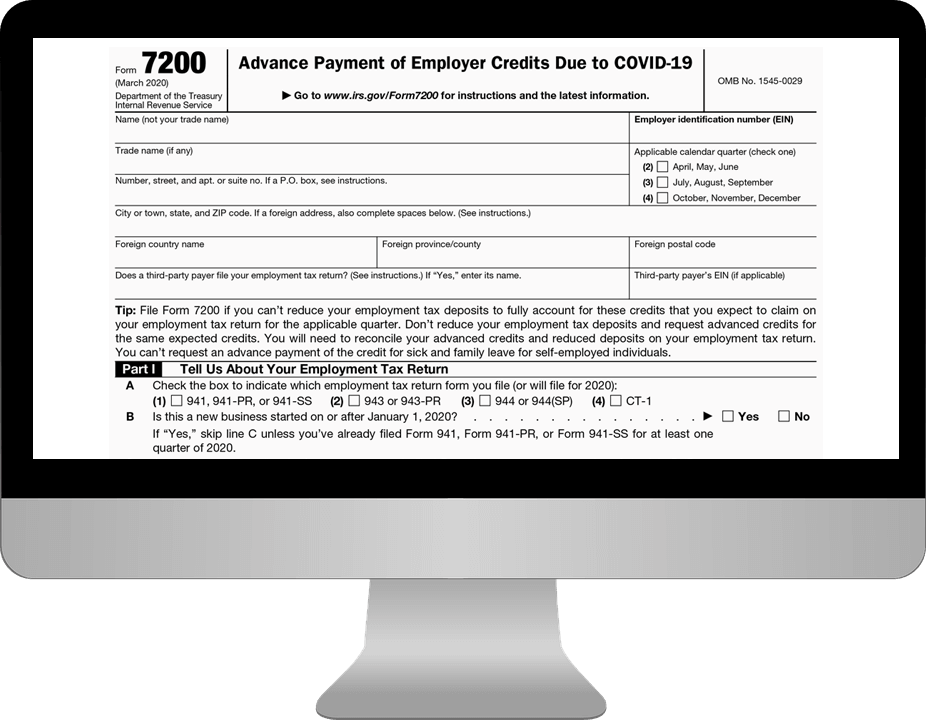

How to File Form 7200 Online with ExpressEfile?

- Enter Your Employer Details

- Choose Applicable calendar quarter

- Choose your Employment Tax Return Type

- Enter your Credits and Advance Requested

- Send it to the IRS by FAX using ExpressEfile

Frequently Asked Questions on Form 7200

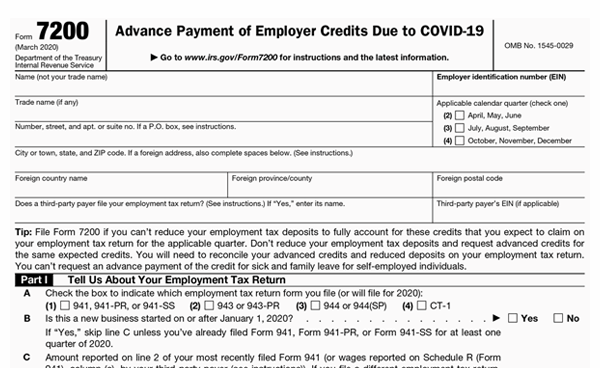

What is the IRS Form 7200?

The IRS has issued Form 7200, Advance Payment of Employer Credits Due to COVID-19. Form 7200 will be used to request an advance payment of tax credits for qualified sick and qualified family leave wages and the employee retention credit that will be claimed on employment tax forms such as Form 941, Form 941-PR, Form 941-SS, Form 943, Form 943-PR, Form 944, Form 944(SP), Form CT-1.

Who must File Form 7200?

Employers who file their any of following employment tax Form 941, 943, 944, or CT-1 may file Form 7200 to request an advance payment of the tax credit for qualified sick, family leave wages, and the employee retention credit.

You have to reconcile any advance credit payments and reduced deposits on your employment tax return(s) that you will file for 2020. No employer is required to file Form 7200.

When to File Form 7200?

You can file the form 7200 for an advance payment of the credits anticipated for a quarter at any time before the end of the month following the quarter in which you paid the qualified wages. If necessary, you can file Form 7200 several times during each quarter.

How is the credit on Form 7200 calculated?

The amount of the credit is 50% of the qualifying wages paid up to $10,000 in total and this is effective only for the wages paid between March 13th and December 31, 2020.

The definition of qualifying wages varies based on the number of employees an employer had in 2019. If the employees' count is less than 100 on average in 2019, then the credit is calculated based on wages paid to all employees. The employer will get the credit for the wages paid to employees whether they worked or not.

Can I Correct Form 7200?

You can’t file a corrected Form 7200 if you have already filed it with the IRS. But, If you find any error on Form 7200, then it can be corrected when you file your employment tax Forms such as 941, 943, 944, or CT-1 for 2020.