Create Fillable and Printable Form

W-2 Online for 2024 Tax Year

- Fill, E-file, Download or

Print Forms - Quick & Secure online filing

- Instant Filing Status

- Postal Mail Employee Copies

Pricing starts as low as $1.49/form

Simplify Your Form W-2 Online Filing with ExpressEfile!

Lowest Price

Pay only $1.49/form, the lowest price in the industry, to e-file your W-2 Form directly with the SSA.

Form Validation

Forms will be scanned and validated for basic errors to ensure that you have transmitted your returns error-free with the SSA.

Instant Filing Status

Receive notifications about the filing status by email once the SSA accepts your Form W-2. You can also check the status right from your account.

Mail Employee Copies

Save your time and money in sending your employee copy. Choose ExpressEfile to mail copies to your employees.

Start E-filing Form W-2. It takes less than 5 minutes.

E-file Form W-2Why should you choose ExpressEfile to E-file Form W2?

Make the smart choice of e-filing with ExpressEfile

E-file Form W-2Frequently Asked Questions on Form W-2

What is Form W2?

Form W-2, Wage and Tax Statement, is filed by employers with the SSA to report their employees' annual wages and taxes withheld from employee paychecks. Employers also send copies of forms to the employees and file W-2 with the state.

When is Form W2 due?

The due date to file Form W-2 with the SSA and send employee copies for the 2024 tax year is January 31, 2025. If you miss filing Form W-2, there will be penalties, you need to pay to the SSA

What are the different copies available for Form W2?

An employer requires to distribute the copies of Form W-2 as follows:

- Copy A — For Social Security Administration

- Copy 1 — For State, City, or Local Tax Department

- Copy D — For Employer’s Records

- Copy B — To Be Filed With Employee’s FEDERAL Tax Return

- Copy C — For Employee’s Records

- Copy 2 — To Be Filed With Employee’s State, City, or Local Income Tax Return

How to complete Form W2 using ExpressEfile?

Get started with ExpressEfile and complete your Form W-2 filing in 3 simple steps.

ExpressEfile is one of the IRS authorized e-file providers that offer the fastest ways to complete your information returns such as Form W-2, 1099-NEC, and 1099-MISC with

the SSA/IRS.

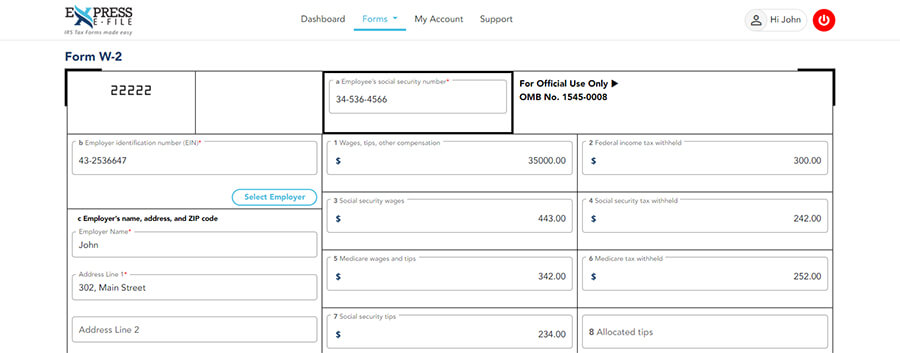

Here is the step-by-step guide to complete your Form W-2 with ExpressEfile.

-

Step 1: Enter Form W-2 Information

Create an account with ExpressEfile and choose Form W-2 from the supported forms. Fill out the form W-2 information as you fill out a physical form.

-

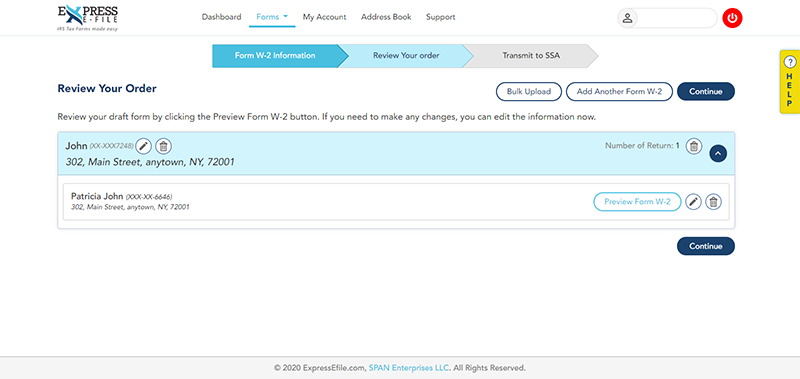

Step 2: Review Form W-2

Review your draft W-2 form and make sure all the information provided is correct. If there are mistakes, you may edit and update the form. Our built-in audit check will also prompt you to correct errors, if any, based on the IRS business rules.

-

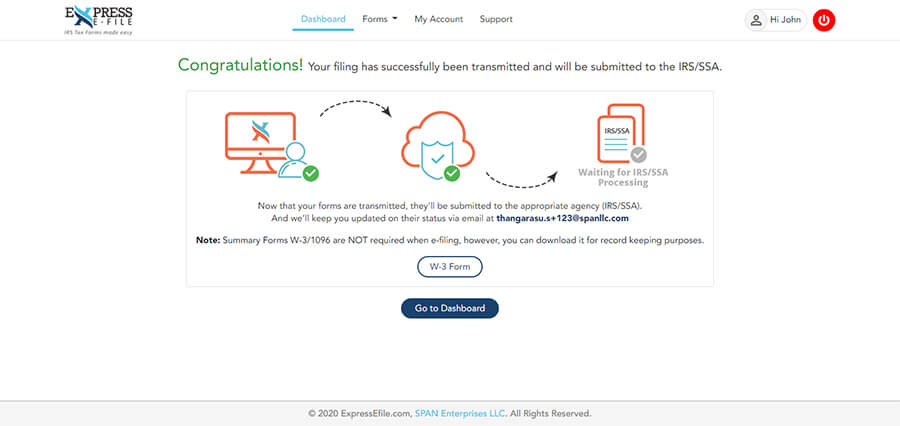

Step 3: Transmit Form W2 to the SSA

If there are no mistakes found on the draft forms, transmit the W2 return directly to the SSA. Once your return is processed, you’ll receive an email.

What is the penalty for not filing Form W2?

You will be charged a penalty under section 6721 if you fail to file Form W-2 by the

due date.

If you file Form W2,

- within 30 days of the due date, you will be charged a penalty of $60 per Form W-2.

- after 30 days of the due date, you will be charged a penalty of $130 per Form W-2.

- after August 1, you will be charged a penalty of $660 per Form W-2.